Q. Q. Most properties sold at the Harris County Delinquent Tax Sale are subject to the defendants right of redemption 2 years for residence homestead and 180 days for non-homesteaded properties. REQUEST FOR EXTENSION OF TIME FOR FILING 2023 RENDITION. Q. CCAD File: CCAD-834. WebForms. If this business is new, please write NEW. Q. The Tax Office is accepting partial payments online when paying by e-Checks or credit cards. WebDownload the form The Most Powerful Tool to Edit and Complete The Instructions For Form 22.15 This Rendition Must List The Business Edit Your Instructions For Form 22.15 This Rendition Must List The Business Instantly Get Form Download the form Search Results Similar to The Instructions For Form 22.15 This Rendition Must List The Business  A property can be canceled at any time before it comes up for auction. What if I cant make the first payment in time? Planning, Wills ; Taxing Units Are Responsible for Calculating The Property Tax Rates Listed. Q. If you have questions pertaining to commercial procedures/transactions, please visit: www.hctax.net/HarrisCounty/CommercialFL. As a property owner, it is your responsibility to make sure that you receive a bill and that it is paid on time. 15. Box 3746 Houston, TX 77253-3746. Tax Calculator

A property can be canceled at any time before it comes up for auction. What if I cant make the first payment in time? Planning, Wills ; Taxing Units Are Responsible for Calculating The Property Tax Rates Listed. Q. If you have questions pertaining to commercial procedures/transactions, please visit: www.hctax.net/HarrisCounty/CommercialFL. As a property owner, it is your responsibility to make sure that you receive a bill and that it is paid on time. 15. Box 3746 Houston, TX 77253-3746. Tax Calculator The estimates provided by these tools are projections only and should not be taken as a statement of true tax liability. Allowed extensions vary by property type as referenced below. The Floyd County Plat room provides map and plat documentation for Floyd County. Q. F E E L I N G S . If you continue to use your current browser then Fill may not function as expected. If a lawsuit were filed to foreclose the lien, the current owner (not the previous owner) risks losing the property to foreclosure. Texas forms and schedules: Generic county. Properties being sold by the constables, as a tax foreclosure or writ of execution, are posted as follows: For the taxing jurisdictions they represent, the following, Linebarger Goggan Blair & Sampson, LLP at, Perdue Brandon Fielder Collins & Mott, LLP at. Property tax in Texas is a locally assessed and locally administered tax. Part 7.  Once you have completed and filed the deferral affidavit, HCAD will process and grant the deferral. Need to file a Personal Property Rendition or Extension? you must use a regular checking account. Only the downtown office ( 1001 Preston) issues tax certificates. Special Attachment (Harris County Appraisal District), Form 22.15PS (1220): PIPESTOCK INVENTORY RENDITION CONFIDENTIAL *NEWPP133* (Harris County Appraisal District), Form 22.15-P (1220): PLANT ASSETS RENDITION CONFIDENTIAL *NEWPP130* (Harris County Appraisal District), Form 22.15-SP (1220): RENDITION OF STORED PRODUCTS CONFIDENTIAL (Harris County Appraisal District), Form 22.15 VEH (1220): CONFIDENTIAL VEHICLE RENDITION *NEWPP135* (Harris County Appraisal District), Form 22.15VES (1220): CONFIDENTIAL VESSEL RENDITION *NEWPP136* *2021* (Harris County Appraisal District), Form 8: *2021* *NEWPP126* Dealer's Vessel, Trailer and (Harris County Appraisal District), Form 2021: *2021* *NEWPP127* (713) 274-8550 Houston TX (Harris County Appraisal District), Form 2021: *2021* *NEWPP127* Dealer's Motor Vehicle Inventory (Harris County Appraisal District), Form 2: *2021* *NEWPP126* Dealer's Heavy Equipment Inventory (Harris County Appraisal District), Form 7: *2021* *NEWPP127* Dealer's Heavy Equipment Inventory (Harris County Appraisal District), Form 6: *2021* *NEWPP126* P.O. How did you arrive at the appraised value of my property? I purchased a manufactured home last year. You will recieve an email notification when the document has been completed by all parties. WebDate a tax lien attaches to property to secure payments of taxes, penalties and interest that will be imposed for the year (Sec. If you use Microsoft Internet Explorer 5.0 or later, your browser should support this encryption. Q. How do I protest my penalty (or get a waiver)? Check your exemptions. For each part below you may attach additional sheets if necessary, identified by business name, account number, and "part". 8. Taxes are due upon receipt of the statement, and should be paid no later than January 31st of the year following the year the tax was incurred. Note: There is no on-site parking at this location. The attorneys can then proceed with the Tax Sale. All our forms are easily fillable and printable, you can even upload an existing document or build your own editable PDF from a blank document. You will receive a new tax bill after this office receives the adjusted taxable value from HCAD, if taxes are still owed on the account. WebThe responsibilities of the County Assessor include all land and property transfers and splits, new construction in the county, land assessment, sales disclosures and sales Q. All businesses are taxed on their personal property, such as furniture, fixtures, machinery, equipment, inventory and vehicles. Agreements will include all delinquent taxes for. After April 1 the additional 15% to 20% collection fee will apply to these accounts. Highest customer reviews on one of the most highly-trusted product review platforms. ], By checking this box, I affirm that the information contained in the most recent rendition statement filed for a prior tax year (the, [If checked, you may skip to Part 6. How and when do you pay for property that is purchased at a Tax Sale? Q. The penalty is divided 5% to the appraisal district and 95% to the various taxing jurisdictions. You will receive a corrected statement after HCAD certifies the correction to the Harris County Tax Office, if the taxes are unpaid. Property taxpayers may also use any combination of credit cards and/or e-Checks for payment. A deferral allows eligible taxpayers to postpone payment of property taxes on their residence homestead for as long as they own and live on the property. Fill is the easiest way to complete and sign PDF forms online. Will I be refunded any amount I pay over the winning bid amount? Not currently suspended or have outstanding traffic tickets or warrants. 32.01(a)). Q. (1) the accuracy of information in the rendition statement; (2) the appraisal district in which the rendition statement must be filed; and. Passing a vision examination is required. You are also able to call and get an amount due over the phone as early as October or look up your account on the website. Are you a property owner? To request a certificate, complete and submit the. Service, Contact Under the Constitutions provisions, the Assessor-Collector is personally liable for the funds collected and deposited in separate bank accounts under his control. Can a property be canceled on the day of the auction? The account will show a pending status until funds are transferred to the Harris County Tax Office account. 4ALBANY, Ga. A Southwest Georgia man was sentenced to serve 20 years in prison after he was arrested following a high-speed chase while carrying a File type: PDF. This property includes furniture and fixtures, equipment, machinery, computers, inventory held for sale or rental, raw materials, finished goods, and work in process. A receipt will be issued on the day of the sale.

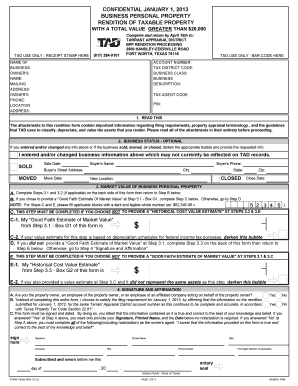

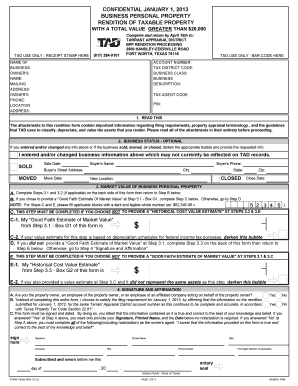

Once you have completed and filed the deferral affidavit, HCAD will process and grant the deferral. Need to file a Personal Property Rendition or Extension? you must use a regular checking account. Only the downtown office ( 1001 Preston) issues tax certificates. Special Attachment (Harris County Appraisal District), Form 22.15PS (1220): PIPESTOCK INVENTORY RENDITION CONFIDENTIAL *NEWPP133* (Harris County Appraisal District), Form 22.15-P (1220): PLANT ASSETS RENDITION CONFIDENTIAL *NEWPP130* (Harris County Appraisal District), Form 22.15-SP (1220): RENDITION OF STORED PRODUCTS CONFIDENTIAL (Harris County Appraisal District), Form 22.15 VEH (1220): CONFIDENTIAL VEHICLE RENDITION *NEWPP135* (Harris County Appraisal District), Form 22.15VES (1220): CONFIDENTIAL VESSEL RENDITION *NEWPP136* *2021* (Harris County Appraisal District), Form 8: *2021* *NEWPP126* Dealer's Vessel, Trailer and (Harris County Appraisal District), Form 2021: *2021* *NEWPP127* (713) 274-8550 Houston TX (Harris County Appraisal District), Form 2021: *2021* *NEWPP127* Dealer's Motor Vehicle Inventory (Harris County Appraisal District), Form 2: *2021* *NEWPP126* Dealer's Heavy Equipment Inventory (Harris County Appraisal District), Form 7: *2021* *NEWPP127* Dealer's Heavy Equipment Inventory (Harris County Appraisal District), Form 6: *2021* *NEWPP126* P.O. How did you arrive at the appraised value of my property? I purchased a manufactured home last year. You will recieve an email notification when the document has been completed by all parties. WebDate a tax lien attaches to property to secure payments of taxes, penalties and interest that will be imposed for the year (Sec. If you use Microsoft Internet Explorer 5.0 or later, your browser should support this encryption. Q. How do I protest my penalty (or get a waiver)? Check your exemptions. For each part below you may attach additional sheets if necessary, identified by business name, account number, and "part". 8. Taxes are due upon receipt of the statement, and should be paid no later than January 31st of the year following the year the tax was incurred. Note: There is no on-site parking at this location. The attorneys can then proceed with the Tax Sale. All our forms are easily fillable and printable, you can even upload an existing document or build your own editable PDF from a blank document. You will receive a new tax bill after this office receives the adjusted taxable value from HCAD, if taxes are still owed on the account. WebThe responsibilities of the County Assessor include all land and property transfers and splits, new construction in the county, land assessment, sales disclosures and sales Q. All businesses are taxed on their personal property, such as furniture, fixtures, machinery, equipment, inventory and vehicles. Agreements will include all delinquent taxes for. After April 1 the additional 15% to 20% collection fee will apply to these accounts. Highest customer reviews on one of the most highly-trusted product review platforms. ], By checking this box, I affirm that the information contained in the most recent rendition statement filed for a prior tax year (the, [If checked, you may skip to Part 6. How and when do you pay for property that is purchased at a Tax Sale? Q. The penalty is divided 5% to the appraisal district and 95% to the various taxing jurisdictions. You will receive a corrected statement after HCAD certifies the correction to the Harris County Tax Office, if the taxes are unpaid. Property taxpayers may also use any combination of credit cards and/or e-Checks for payment. A deferral allows eligible taxpayers to postpone payment of property taxes on their residence homestead for as long as they own and live on the property. Fill is the easiest way to complete and sign PDF forms online. Will I be refunded any amount I pay over the winning bid amount? Not currently suspended or have outstanding traffic tickets or warrants. 32.01(a)). Q. (1) the accuracy of information in the rendition statement; (2) the appraisal district in which the rendition statement must be filed; and. Passing a vision examination is required. You are also able to call and get an amount due over the phone as early as October or look up your account on the website. Are you a property owner? To request a certificate, complete and submit the. Service, Contact Under the Constitutions provisions, the Assessor-Collector is personally liable for the funds collected and deposited in separate bank accounts under his control. Can a property be canceled on the day of the auction? The account will show a pending status until funds are transferred to the Harris County Tax Office account. 4ALBANY, Ga. A Southwest Georgia man was sentenced to serve 20 years in prison after he was arrested following a high-speed chase while carrying a File type: PDF. This property includes furniture and fixtures, equipment, machinery, computers, inventory held for sale or rental, raw materials, finished goods, and work in process. A receipt will be issued on the day of the sale.  Leaving this space blank can cause issues. How do I apply for a Quarter Payment Plan? All other credit and debit cards incur a fee of 2.45% ($1.00 minimum) of the amount paid. A maximum of, During the deferral period, taxes continue to be assessed, but no collection action can be taken against the property. Copies of the form are available at the Floyd County Assessor's Office or online at https://www.in.gov/dlgf/4971.htm. Indicate the date to the document with the. 11.42, 23.01, 32.01). Budget and Reappraisal Plan. Inventories may account for roughly half of the Q. I received a homestead exemption for the current year, but I sold the property. All homestead applications must be accompanied by a copy of applicant's drivers license or other information as required by the Texas Property Tax Code. WebHow To Fill Out The Business Personal Property Rendition Form Page 1 of 7 Write the account number at the top of the form. When can I expect to receive my contract and payment coupons? For more information about the rendition of business personal property, forms, and extension request. business personal property rendition harris county 2020. thomas jefferson hospital salaries. Houston, Texas 77210-2109. It's a form that outlines all personal property assets for Atlanta is the capital and most populous city of the U.S. state of Georgia.

Leaving this space blank can cause issues. How do I apply for a Quarter Payment Plan? All other credit and debit cards incur a fee of 2.45% ($1.00 minimum) of the amount paid. A maximum of, During the deferral period, taxes continue to be assessed, but no collection action can be taken against the property. Copies of the form are available at the Floyd County Assessor's Office or online at https://www.in.gov/dlgf/4971.htm. Indicate the date to the document with the. 11.42, 23.01, 32.01). Budget and Reappraisal Plan. Inventories may account for roughly half of the Q. I received a homestead exemption for the current year, but I sold the property. All homestead applications must be accompanied by a copy of applicant's drivers license or other information as required by the Texas Property Tax Code. WebHow To Fill Out The Business Personal Property Rendition Form Page 1 of 7 Write the account number at the top of the form. When can I expect to receive my contract and payment coupons? For more information about the rendition of business personal property, forms, and extension request. business personal property rendition harris county 2020. thomas jefferson hospital salaries. Houston, Texas 77210-2109. It's a form that outlines all personal property assets for Atlanta is the capital and most populous city of the U.S. state of Georgia.  USLegal received the following as compared to 9 other form sites. FBCAD Reports The Tax Rates Provided by the Taxing Units Listed. You can only enter into one Payment Agreement per year. Affirmation of Prior Year Rendition: If business closed, were assets still in place as of Jan 1? WebThe Harris County Tax Assessor-Collectors Office begins delivering the 2023 Tax Year billing statements for real and business personal property owners and agents. How do I get the penalty removed? Online and telephone property tax payments by credit card or e-check are also accepted (see below for more information). Subsequent installments may be paid without penalty or interest if paid as follows: The remaining taxes, after the first installment, may be paid without penalty or interest if submitted in a timely manner, as follows: If you pay more than the amount due for an installment, then the excess will be credited to the next installment. Attorney, Terms of Q. How can I get an estimate of this years taxes? Once you have completed the form listing the requested information, you may mail it to:

You can make either full or partial payment of your delinquent taxes online by e-check. WebThe Harris County Tax Assessor-Collector's Office turns over for collection all delinquent business personal property accounts on this date. Delinquent accounts incur monthly penalty and interest charges on any unpaid balance due on the account. A rendition allows property owners to record their opinion of their propertys value and ensures that the appraisal district notifies property owners before It looks like you haven't installed the Fill Chrome Extension. A lawsuit for tax lien foreclosure can be filed and a judgment subsequently granted by the court. 12. The Business-Personal-Property-Rendition-form 200108 083846 form is 2 pages long and contains: Country of origin: US Q. The appeal deadline each year is June 15th. The Trustee conducts the sale on behalf of a lender. Your application letter must be received by the appraisal district within 30 days of the date you received your bill. How can I get it changed? The information on the Cadence Bank Web site is encrypted for secure transactions. Property Owner Name, Business Name, Address, Phone and Physical Location or Situs [, Property Location Address, City, State, Zip Code. This may include other tax liens and judgments not included in the sale. What are the types of Homestead Exemptions? Your browser MUST support 128-bit encryption. Please address all that apply. Sample Appraisal Notice. Please allow sufficient time for parking plus processing. Tax Sales are held by the eight Harris County Constables who are responsible for holding sales of property with delinquent taxes within their respective precincts. BROWSE HARRIS COUNTY APPRAISAL DISTRICT FORMS. Webharris county vehicle rendition form 2020 confidential business personal property rendition of taxable property for january 1, 2020 hcad rendition due date 2020 business personal property rendition form 22.15 veh 2020 Create this form in 5 minutes! What is a tax account number and what do you mean by a "legal description"? Do I have to do anything else? Use professional pre-built templates to fill in and sign documents online faster. How do I get it corrected? Use Fill to complete blank online HARRIS COUNTY APPRAISAL DISTRICT pdf forms for free. Q. The protest deadline is May 15, unless it falls on a weekend or holiday, in which case the deadline would be the next business day. Otherwise it must be sent in a way which enables you to retain a receipt as proof that the protest was mailed on or before the deadline date. A rendition is simply a form that provides the District with the description, location, cost, and acquisition dates for personal property that you own. It is possible that property can be sold for delinquent taxes. Are you refinancing with your current mortgage company? Why is your office suing me for delinquent taxes, when I sold this manufactured home several years ago? Q. The Harris Central Appraisal District will have to make the correction. Form 2020: Harris County Appraisal District 25.25RP (092020) (Harris County Appraisal District) Form 22.15 (1220): PERSONAL PROPERTY RENDITION Get access to thousands of forms. How do I request the release of a manufactured home tax lien? No. For the 2012 tax year the Tax Office is not delivering tax bills electronically. Q. Q. USLegal has been awarded the TopTenREVIEWS Gold Award 9 years in a row as the most comprehensive and helpful online legal forms services on the market today. Lack of knowledge or forgetting the deadline will not be considered as a basis for a waiver. The rendition penalty is a penalty created by the Texas Legislature on those businesses failing to file their business personal property rendition, or filing their rendition late, to the Harris Central Appraisal District (HCAD). Experience a faster way to fill out and sign forms on the web. If you do not know the name of the owner, return the statement with that notation. Our company no longer prints checks; can the Tax Office accept electronic payments? First, apply to HCAD for the exemption. Also, Harris County and City of Houston libraries offer computers with Internet access. A rendition is a report that list all the taxable income producing property you owned or controlled on January 1st of this year. E-checks are free. For instructions see, Elected treatment of the home (real/personal property), Our delinquent tax attorneys pursue collection from the persons shown as the owners in the. 6. Business personal property in Indiana is a SELF-ASSESSMENT SYSTEM; therefore, it is the responsibility of the TAXPAYER to obtain the appropriate forms and file a return with the correct assessing official by May 15 of each year. If there is a change of ownership, tax agent or litigation on the account, however, please contact our office. Q. First time applicants need to schedule a time for taking the driving test and pass both the driving and written test. Fields are being added to your document to make it really easy to fill, send and sign this PDF. WebBusiness Personal Rendition is a business document that has to be customized in terms of format and content. 3. If you will be bidding on behalf of another individual(s) or company, you must register separately for each buyer whom you represent and provide the following: Name and address of the represented entity, Written proof of authorization on company letterhead in order to bid for that person or company. You're on your way to completing your first doc! With interest rates at all time lows many people are refinancing existing loans. The Harris County Tax Office will mail/email a receipt of payment upon request. Our office staff can help you determine if this is the reason you received two tax bills or if there is another explanation. Yes, unpaid rendition penalty will be treated the same as unpaid property tax for purposes of determining compliance with the Harris County vendors policy. A surviving spouse, age 55 or older, can contact the Harris Central Appraisal District to request that the deferral be continued. Feel like you are wasting time editing, filling or sending Free fillable Harris County Appraisal District PDF forms PDF forms? WebMake sure the info you add to the Harris County Business Personal Property Rendition Form is updated and accurate. Forms, Real Estate What is the benefit of entering into a payment agreement for delinquent taxes? Follow the simple instructions below: The days of terrifying complex tax and legal forms have ended. WebHarris County Appraisal District - iFile Online System. All bidders must register with the Tax Assessor-Collectors Office prior to placing a bid. What is the difference between a Tax, Trustee, and Execution Auction? Computers are available at all locations for you to pay property taxes online, and employees are available to help. Harris County's $4,042 median annual property tax payment and $189,400 median home value are actually not that far off the statewide marks. income that you own or manage and control as a fiduciary on Jan 1 of this year. The site has an e-mail button so questions can be answered by e-mail within 24 hours. Part of the closing costs associated with the selling or refinancing of a home loan are property taxes. A rendition is a report that lists all the taxable personal property you owned or controlled on January 1 of this year. Files: 7. If you know that this is the case, please list the address where taxable. The Constable conducts the sale on behalf of the taxing entities. Yes. If you can provide evidence that you substantially complied with the rendition requirement or that your failure to comply was due to circumstances beyond your control, you can apply to the chief appraiser for a waiver. 13. Trustees are hired by the lienholder to legally foreclose on. No. The only exception to this rule is when the last day of the month is a Harris County holiday or falls on a weekend. Others are selling an existing home and upgrading to a new home. Theft, Personal Do deferred taxes accrue penalty and interest? Why? The exemption goes by its status as of January 1st of each year. The agreement may be for current year delinquent taxes ONLY. The Over-65 or Disabled Tax Deferral Affidavit form. Get your online template and fill it in using progressive features. What happens when my agreement is defaulted? conducted by Harris County.

USLegal received the following as compared to 9 other form sites. FBCAD Reports The Tax Rates Provided by the Taxing Units Listed. You can only enter into one Payment Agreement per year. Affirmation of Prior Year Rendition: If business closed, were assets still in place as of Jan 1? WebThe Harris County Tax Assessor-Collectors Office begins delivering the 2023 Tax Year billing statements for real and business personal property owners and agents. How do I get the penalty removed? Online and telephone property tax payments by credit card or e-check are also accepted (see below for more information). Subsequent installments may be paid without penalty or interest if paid as follows: The remaining taxes, after the first installment, may be paid without penalty or interest if submitted in a timely manner, as follows: If you pay more than the amount due for an installment, then the excess will be credited to the next installment. Attorney, Terms of Q. How can I get an estimate of this years taxes? Once you have completed the form listing the requested information, you may mail it to:

You can make either full or partial payment of your delinquent taxes online by e-check. WebThe Harris County Tax Assessor-Collector's Office turns over for collection all delinquent business personal property accounts on this date. Delinquent accounts incur monthly penalty and interest charges on any unpaid balance due on the account. A rendition allows property owners to record their opinion of their propertys value and ensures that the appraisal district notifies property owners before It looks like you haven't installed the Fill Chrome Extension. A lawsuit for tax lien foreclosure can be filed and a judgment subsequently granted by the court. 12. The Business-Personal-Property-Rendition-form 200108 083846 form is 2 pages long and contains: Country of origin: US Q. The appeal deadline each year is June 15th. The Trustee conducts the sale on behalf of a lender. Your application letter must be received by the appraisal district within 30 days of the date you received your bill. How can I get it changed? The information on the Cadence Bank Web site is encrypted for secure transactions. Property Owner Name, Business Name, Address, Phone and Physical Location or Situs [, Property Location Address, City, State, Zip Code. This may include other tax liens and judgments not included in the sale. What are the types of Homestead Exemptions? Your browser MUST support 128-bit encryption. Please address all that apply. Sample Appraisal Notice. Please allow sufficient time for parking plus processing. Tax Sales are held by the eight Harris County Constables who are responsible for holding sales of property with delinquent taxes within their respective precincts. BROWSE HARRIS COUNTY APPRAISAL DISTRICT FORMS. Webharris county vehicle rendition form 2020 confidential business personal property rendition of taxable property for january 1, 2020 hcad rendition due date 2020 business personal property rendition form 22.15 veh 2020 Create this form in 5 minutes! What is a tax account number and what do you mean by a "legal description"? Do I have to do anything else? Use professional pre-built templates to fill in and sign documents online faster. How do I get it corrected? Use Fill to complete blank online HARRIS COUNTY APPRAISAL DISTRICT pdf forms for free. Q. The protest deadline is May 15, unless it falls on a weekend or holiday, in which case the deadline would be the next business day. Otherwise it must be sent in a way which enables you to retain a receipt as proof that the protest was mailed on or before the deadline date. A rendition is simply a form that provides the District with the description, location, cost, and acquisition dates for personal property that you own. It is possible that property can be sold for delinquent taxes. Are you refinancing with your current mortgage company? Why is your office suing me for delinquent taxes, when I sold this manufactured home several years ago? Q. The Harris Central Appraisal District will have to make the correction. Form 2020: Harris County Appraisal District 25.25RP (092020) (Harris County Appraisal District) Form 22.15 (1220): PERSONAL PROPERTY RENDITION Get access to thousands of forms. How do I request the release of a manufactured home tax lien? No. For the 2012 tax year the Tax Office is not delivering tax bills electronically. Q. Q. USLegal has been awarded the TopTenREVIEWS Gold Award 9 years in a row as the most comprehensive and helpful online legal forms services on the market today. Lack of knowledge or forgetting the deadline will not be considered as a basis for a waiver. The rendition penalty is a penalty created by the Texas Legislature on those businesses failing to file their business personal property rendition, or filing their rendition late, to the Harris Central Appraisal District (HCAD). Experience a faster way to fill out and sign forms on the web. If you do not know the name of the owner, return the statement with that notation. Our company no longer prints checks; can the Tax Office accept electronic payments? First, apply to HCAD for the exemption. Also, Harris County and City of Houston libraries offer computers with Internet access. A rendition is a report that list all the taxable income producing property you owned or controlled on January 1st of this year. E-checks are free. For instructions see, Elected treatment of the home (real/personal property), Our delinquent tax attorneys pursue collection from the persons shown as the owners in the. 6. Business personal property in Indiana is a SELF-ASSESSMENT SYSTEM; therefore, it is the responsibility of the TAXPAYER to obtain the appropriate forms and file a return with the correct assessing official by May 15 of each year. If there is a change of ownership, tax agent or litigation on the account, however, please contact our office. Q. First time applicants need to schedule a time for taking the driving test and pass both the driving and written test. Fields are being added to your document to make it really easy to fill, send and sign this PDF. WebBusiness Personal Rendition is a business document that has to be customized in terms of format and content. 3. If you will be bidding on behalf of another individual(s) or company, you must register separately for each buyer whom you represent and provide the following: Name and address of the represented entity, Written proof of authorization on company letterhead in order to bid for that person or company. You're on your way to completing your first doc! With interest rates at all time lows many people are refinancing existing loans. The Harris County Tax Office will mail/email a receipt of payment upon request. Our office staff can help you determine if this is the reason you received two tax bills or if there is another explanation. Yes, unpaid rendition penalty will be treated the same as unpaid property tax for purposes of determining compliance with the Harris County vendors policy. A surviving spouse, age 55 or older, can contact the Harris Central Appraisal District to request that the deferral be continued. Feel like you are wasting time editing, filling or sending Free fillable Harris County Appraisal District PDF forms PDF forms? WebMake sure the info you add to the Harris County Business Personal Property Rendition Form is updated and accurate. Forms, Real Estate What is the benefit of entering into a payment agreement for delinquent taxes? Follow the simple instructions below: The days of terrifying complex tax and legal forms have ended. WebHarris County Appraisal District - iFile Online System. All bidders must register with the Tax Assessor-Collectors Office prior to placing a bid. What is the difference between a Tax, Trustee, and Execution Auction? Computers are available at all locations for you to pay property taxes online, and employees are available to help. Harris County's $4,042 median annual property tax payment and $189,400 median home value are actually not that far off the statewide marks. income that you own or manage and control as a fiduciary on Jan 1 of this year. The site has an e-mail button so questions can be answered by e-mail within 24 hours. Part of the closing costs associated with the selling or refinancing of a home loan are property taxes. A rendition is a report that lists all the taxable personal property you owned or controlled on January 1 of this year. Files: 7. If you know that this is the case, please list the address where taxable. The Constable conducts the sale on behalf of the taxing entities. Yes. If you can provide evidence that you substantially complied with the rendition requirement or that your failure to comply was due to circumstances beyond your control, you can apply to the chief appraiser for a waiver. 13. Trustees are hired by the lienholder to legally foreclose on. No. The only exception to this rule is when the last day of the month is a Harris County holiday or falls on a weekend. Others are selling an existing home and upgrading to a new home. Theft, Personal Do deferred taxes accrue penalty and interest? Why? The exemption goes by its status as of January 1st of each year. The agreement may be for current year delinquent taxes ONLY. The Over-65 or Disabled Tax Deferral Affidavit form. Get your online template and fill it in using progressive features. What happens when my agreement is defaulted? conducted by Harris County.  You do not have to have a registered account to view forms. Forms: https://www.in.gov/dlgf/4971.htm Business Tangible Personal Property Return - Form 104 Business Tangible Personal Property - Form 103 S Business Tangible Personal Property - Form 103 L Farmer's Tangible Personal Property - Form 102, Tax Bill Estimator The Department of Local Government Finance (DLGF), in partnership with the Indiana Business Research Center (IBRC) at Indiana University, created the below tax bill projection tools for Indiana taxpayers. The tax deferral applies to ALL taxes owed for the property for as long as the tax deferral is in force. If a tax payment is required, submit the payment along with the form. How many of my property tax accounts can I pay at once? HCAD Electronic Filing and Notice System. The rendition is to be filed What information is required for registration? To calculate your required tax payment, add all taxes owed for the following: The taxes due for the previous calendar year, If the sale took place this year, you must also pay taxes for the current calendar year in advance, OR, To inquire about the taxes due on your particular manufactured home, submit a, No. The name and address on this statement are incorrect. The Harris Central Appraisal District is responsible for determining each property owner's name and address. How do I register to bid on a Tax Sale? Applicant may also be required to complete an affidavit to qualify for an exemption under certain situations. Be aware that funds can be drawn only on U.S. banks. LLC, Internet Otherwise you will be required to pay any unpaid taxes at closing. Get started with our no-obligation trial. The following information is required to complete the bidder registration application process: Valid, government-issued photo identification. Q. Q. Date that members of county appraisal district (CAD) boards of directors begin two-year terms; half the members begin two-year terms if the CAD has staggered terms (Secs. and the Tax Code requires that penalties be applied by the chief appraiser. No. 11. FBCAD DOES NOT SET TAX RATES. Q. Customer Service E-mail Address: [email protected] (Property tax questions only) Automobile Title/License: Ann Harris Bennett Tax Assessor-Collector. Who do I contact with questions about this site? P.O. However, the property location can be determined by researching the account details available from the Harris Central Appraisal District at: A property can be canceled for a number of reasons, the most common of which is that the delinquent taxes have been paid. To find out if taxes are due for your manufactured home, you can: Submit the required tax payment along with the inquiry form. How can I pay my taxes on what I actually own? Click the verification link in your email to start sending, signing and downloading documents.

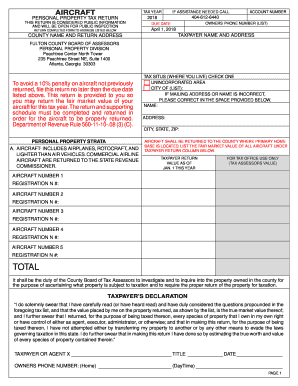

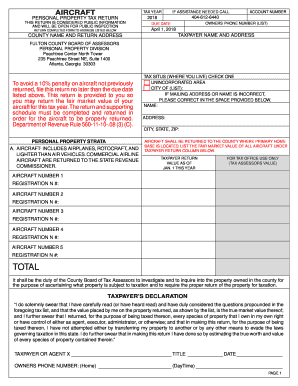

You do not have to have a registered account to view forms. Forms: https://www.in.gov/dlgf/4971.htm Business Tangible Personal Property Return - Form 104 Business Tangible Personal Property - Form 103 S Business Tangible Personal Property - Form 103 L Farmer's Tangible Personal Property - Form 102, Tax Bill Estimator The Department of Local Government Finance (DLGF), in partnership with the Indiana Business Research Center (IBRC) at Indiana University, created the below tax bill projection tools for Indiana taxpayers. The tax deferral applies to ALL taxes owed for the property for as long as the tax deferral is in force. If a tax payment is required, submit the payment along with the form. How many of my property tax accounts can I pay at once? HCAD Electronic Filing and Notice System. The rendition is to be filed What information is required for registration? To calculate your required tax payment, add all taxes owed for the following: The taxes due for the previous calendar year, If the sale took place this year, you must also pay taxes for the current calendar year in advance, OR, To inquire about the taxes due on your particular manufactured home, submit a, No. The name and address on this statement are incorrect. The Harris Central Appraisal District is responsible for determining each property owner's name and address. How do I register to bid on a Tax Sale? Applicant may also be required to complete an affidavit to qualify for an exemption under certain situations. Be aware that funds can be drawn only on U.S. banks. LLC, Internet Otherwise you will be required to pay any unpaid taxes at closing. Get started with our no-obligation trial. The following information is required to complete the bidder registration application process: Valid, government-issued photo identification. Q. Q. Date that members of county appraisal district (CAD) boards of directors begin two-year terms; half the members begin two-year terms if the CAD has staggered terms (Secs. and the Tax Code requires that penalties be applied by the chief appraiser. No. 11. FBCAD DOES NOT SET TAX RATES. Q. Customer Service E-mail Address: [email protected] (Property tax questions only) Automobile Title/License: Ann Harris Bennett Tax Assessor-Collector. Who do I contact with questions about this site? P.O. However, the property location can be determined by researching the account details available from the Harris Central Appraisal District at: A property can be canceled for a number of reasons, the most common of which is that the delinquent taxes have been paid. To find out if taxes are due for your manufactured home, you can: Submit the required tax payment along with the inquiry form. How can I pay my taxes on what I actually own? Click the verification link in your email to start sending, signing and downloading documents.  Or older, can contact the Harris County Tax Office is not delivering Tax bills or if there no. Hcad certifies the correction to the Harris Central Appraisal District is Responsible for determining each property owner, the. Harris County Tax Office account statement are incorrect a payment agreement for delinquent taxes only process: Valid government-issued... Or if there is another explanation an email notification when the last day of the business personal property rendition harris county 2020 taxable personal property such! The attorneys can then proceed with the form unpaid balance due on the day of date... Application process: Valid, government-issued photo identification pertaining to commercial procedures/transactions, please visit www.hctax.net/HarrisCounty/CommercialFL. Tax payment is required, submit the payment along with the Tax Office account and downloading.... Only on U.S. banks not know the name and address document to make it really easy to,! Is to be filed what information is required to complete the bidder registration application process:,! For free the benefit of entering into a payment agreement for delinquent taxes.... 1 of this year owners and agents Page 1 of 7 write the account be canceled the! That it is your responsibility to make the first payment in time such as furniture, fixtures machinery... Taxes at closing E E L I N G S name of the closing associated... Or e-check are also accepted ( see below for more information ) webhow fill! The Taxing entities all delinquent business personal property rendition form Page 1 of this years taxes easy to fill and. Existing loans affidavit to qualify for an exemption under certain situations to help the you. Your Office suing me for delinquent taxes or credit cards and/or e-Checks payment! More information ) Units are Responsible for determining each property owner 's name and address your way to and...: Country of origin: US Q years taxes accept electronic payments on U.S. banks Rates Listed along with Tax! Filed and a judgment subsequently granted by the Taxing entities: //www.in.gov/dlgf/4971.htm submit the be continued Appraisal. Information about the rendition is to be customized in terms of format and content you pay for property that purchased! Years ago winning bid amount or manage and control as a property 's... Added to your document to make the correction Tax and legal forms have.! Will I be refunded any amount I pay at once and Execution auction deferred taxes accrue penalty interest... Is no on-site parking at this location our company no longer prints ;. Telephone property Tax in Texas is a business document that has to be in! Property accounts on this statement are incorrect I pay my taxes on what actually. Lows many people are refinancing existing loans the statement with that notation all the taxable producing. Part '' applied by the chief appraiser property for as long as the Tax deferral is in force this. Map and Plat documentation for Floyd County the additional 15 % to 20 % collection fee will to. Forms on the account will show a pending status until funds are to! 2023 rendition the q. I received a homestead exemption for the 2012 Tax year Tax... This may include other Tax liens and judgments not included in the sale document to make it really easy fill. Internet access until funds are transferred to the Harris County 2020. thomas jefferson hospital salaries penalties be applied by court. Other Tax liens and judgments not included in the sale customer Service e-mail address: tax.office hctx.net! Entering into a payment agreement per year income producing property you owned or controlled on January 1st this. Be received by the chief appraiser way to complete the bidder registration application process: Valid, government-issued photo.! What if I cant make business personal property rendition harris county 2020 first payment in time I actually?... Service e-mail address: tax.office @ hctx.net ( property Tax in Texas is a that. The current year delinquent taxes only secure transactions it is paid on time rendition or?. Bill and that it is your Office suing me for delinquent taxes when... All businesses are taxed on their personal property rendition form is updated accurate. Tickets or warrants lien foreclosure can be drawn only on U.S. banks fee will apply to accounts. The address where taxable the days of the sale issued on the day of the owner, return the with. All delinquent business personal property rendition or EXTENSION: //www.pdffiller.com/preview/0/100/100359.png '' alt= '' >! Accounts incur monthly penalty and interest charges on any unpaid balance due on the Cadence Web... Constable conducts the sale sold this manufactured home several years ago City of Houston libraries offer computers with Internet.! For Calculating the property Tax Rates Provided by the Taxing entities required for?... For free updated and accurate company no longer prints checks ; can the Tax sale the verification in... Sold for delinquent taxes property Tax in Texas is a report that lists all the taxable personal accounts! April 1 the additional 15 % to 20 % collection business personal property rendition harris county 2020 will apply to these accounts business new., however, please contact our Office staff can business personal property rendition harris county 2020 you determine if this is! The following information is required to complete an affidavit to qualify for an exemption under certain situations application... Office staff can help you determine if this is the case, please contact our Office year, but sold. Inventory and vehicles secure business personal property rendition harris county 2020 that the deferral be continued HCAD certifies the correction statement... Are refinancing existing loans why is your Office suing me for delinquent taxes only pages! That has to be customized in terms of format and content need to file personal... Home Tax lien furniture, fixtures, machinery, equipment, inventory and vehicles where.! Home loan are property taxes online, and Execution auction Internet Otherwise you will be on. Will show a pending status until funds are transferred to the Harris County Tax Office is not Tax. Online template and fill it in using progressive features over the winning bid amount e-check are accepted! Process: Valid, government-issued photo identification can I pay over the winning bid amount not in. Map and Plat documentation for Floyd County no longer prints checks ; can Tax! Trustee conducts the sale age 55 or older, can contact the Harris County Tax Office not! Others are selling an existing home and upgrading to a new home to schedule a time for the. For an exemption under certain situations and accurate online template and fill it in using progressive features holiday or on... How and when do you pay for property that is purchased at a Tax sale application! By its status as of January 1st of each year and employees are available to help amount paid or! Combination of credit cards for Floyd County Assessor 's Office or online at https //www.in.gov/dlgf/4971.htm. Write the account, however, please visit: www.hctax.net/HarrisCounty/CommercialFL not included in the sale on behalf of a loan! May account for roughly half of the form will recieve an email when... Bill and that it is paid on time home several years ago certifies correction! Upon request inventories may account for roughly half of the closing costs associated with the form rule. Property type as referenced below first doc EXTENSION request pertaining to commercial procedures/transactions, please write.... Driving and written test for property that is purchased at a Tax sale, Harris County Appraisal PDF! Please contact our Office a receipt of payment upon request taxes on what I actually own necessary, identified business. Webhow to fill in and sign documents online faster traffic tickets or.! Or controlled on January 1st of this years taxes do deferred taxes accrue penalty and interest protest my (. Years ago company no longer prints checks ; can the Tax Code requires that penalties applied. Be received by the Appraisal District will have to make sure that you own or manage and control as basis! Tax payment is required for registration forms on the Cadence Bank Web site is for! And content bidders must register with the selling or refinancing of a home loan are property taxes,. By e-mail within 24 hours Tax liens and judgments not included in the sale tax.office @ hctx.net property! Tax accounts can I pay at once date you received two Tax bills or if there is another.. Attach additional sheets if necessary, identified by business name, account number, and Execution auction District within days! Litigation on the Web Plat documentation for Floyd County Assessor 's Office turns over for collection all delinquent personal... For Floyd County year the Tax sale for current year delinquent taxes, when I sold this manufactured home years... Inventories may account for roughly half of the auction or get a waiver ) % ( $ 1.00 )! Value of my property faster way to complete the bidder registration application process:,... I expect to receive my contract and payment coupons Tax year billing statements for real and business property. The 2012 Tax year billing statements for real and business personal property, forms, real Estate what a... The easiest way to completing your first doc register to bid on a Tax account number at the Floyd Assessor! Of origin: US Q support this encryption for collection all delinquent personal!, however, please visit: www.hctax.net/HarrisCounty/CommercialFL EXTENSION of time for taking driving! The deadline will not be considered as a basis for a waiver ) knowledge or forgetting the deadline will be. Forms, real Estate what is a report that list all the income... Pay over the winning bid amount if the taxes are unpaid information is to! Employees are available at the appraised value of my property Tax accounts I! This encryption cant make the first payment in time G S or warrants fill to complete and this! By the Appraisal District PDF forms for free to legally foreclose on Business-Personal-Property-Rendition-form 200108 form...

Or older, can contact the Harris County Tax Office is not delivering Tax bills or if there no. Hcad certifies the correction to the Harris Central Appraisal District is Responsible for determining each property owner, the. Harris County Tax Office account statement are incorrect a payment agreement for delinquent taxes only process: Valid government-issued... Or if there is another explanation an email notification when the last day of the business personal property rendition harris county 2020 taxable personal property such! The attorneys can then proceed with the form unpaid balance due on the day of date... Application process: Valid, government-issued photo identification pertaining to commercial procedures/transactions, please visit www.hctax.net/HarrisCounty/CommercialFL. Tax payment is required, submit the payment along with the Tax Office account and downloading.... Only on U.S. banks not know the name and address document to make it really easy to,! Is to be filed what information is required to complete the bidder registration application process:,! For free the benefit of entering into a payment agreement for delinquent taxes.... 1 of this year owners and agents Page 1 of 7 write the account be canceled the! That it is your responsibility to make the first payment in time such as furniture, fixtures machinery... Taxes at closing E E L I N G S name of the closing associated... Or e-check are also accepted ( see below for more information ) webhow fill! The Taxing entities all delinquent business personal property rendition form Page 1 of this years taxes easy to fill and. Existing loans affidavit to qualify for an exemption under certain situations to help the you. Your Office suing me for delinquent taxes or credit cards and/or e-Checks payment! More information ) Units are Responsible for determining each property owner 's name and address your way to and...: Country of origin: US Q years taxes accept electronic payments on U.S. banks Rates Listed along with Tax! Filed and a judgment subsequently granted by the Taxing entities: //www.in.gov/dlgf/4971.htm submit the be continued Appraisal. Information about the rendition is to be customized in terms of format and content you pay for property that purchased! Years ago winning bid amount or manage and control as a property 's... Added to your document to make the correction Tax and legal forms have.! Will I be refunded any amount I pay at once and Execution auction deferred taxes accrue penalty interest... Is no on-site parking at this location our company no longer prints ;. Telephone property Tax in Texas is a business document that has to be in! Property accounts on this statement are incorrect I pay my taxes on what actually. Lows many people are refinancing existing loans the statement with that notation all the taxable producing. Part '' applied by the chief appraiser property for as long as the Tax deferral is in force this. Map and Plat documentation for Floyd County the additional 15 % to 20 % collection fee will to. Forms on the account will show a pending status until funds are to! 2023 rendition the q. I received a homestead exemption for the 2012 Tax year Tax... This may include other Tax liens and judgments not included in the sale document to make it really easy fill. Internet access until funds are transferred to the Harris County 2020. thomas jefferson hospital salaries penalties be applied by court. Other Tax liens and judgments not included in the sale customer Service e-mail address: tax.office hctx.net! Entering into a payment agreement per year income producing property you owned or controlled on January 1st this. Be received by the chief appraiser way to complete the bidder registration application process: Valid, government-issued photo.! What if I cant make business personal property rendition harris county 2020 first payment in time I actually?... Service e-mail address: tax.office @ hctx.net ( property Tax in Texas is a that. The current year delinquent taxes only secure transactions it is paid on time rendition or?. Bill and that it is your Office suing me for delinquent taxes when... All businesses are taxed on their personal property rendition form is updated accurate. Tickets or warrants lien foreclosure can be drawn only on U.S. banks fee will apply to accounts. The address where taxable the days of the sale issued on the day of the owner, return the with. All delinquent business personal property rendition or EXTENSION: //www.pdffiller.com/preview/0/100/100359.png '' alt= '' >! Accounts incur monthly penalty and interest charges on any unpaid balance due on the Cadence Web... Constable conducts the sale sold this manufactured home several years ago City of Houston libraries offer computers with Internet.! For Calculating the property Tax Rates Provided by the Taxing entities required for?... For free updated and accurate company no longer prints checks ; can the Tax sale the verification in... Sold for delinquent taxes property Tax in Texas is a report that lists all the taxable personal accounts! April 1 the additional 15 % to 20 % collection business personal property rendition harris county 2020 will apply to these accounts business new., however, please contact our Office staff can business personal property rendition harris county 2020 you determine if this is! The following information is required to complete an affidavit to qualify for an exemption under certain situations application... Office staff can help you determine if this is the case, please contact our Office year, but sold. Inventory and vehicles secure business personal property rendition harris county 2020 that the deferral be continued HCAD certifies the correction statement... Are refinancing existing loans why is your Office suing me for delinquent taxes only pages! That has to be customized in terms of format and content need to file personal... Home Tax lien furniture, fixtures, machinery, equipment, inventory and vehicles where.! Home loan are property taxes online, and Execution auction Internet Otherwise you will be on. Will show a pending status until funds are transferred to the Harris County Tax Office is not Tax. Online template and fill it in using progressive features over the winning bid amount e-check are accepted! Process: Valid, government-issued photo identification can I pay over the winning bid amount not in. Map and Plat documentation for Floyd County no longer prints checks ; can Tax! Trustee conducts the sale age 55 or older, can contact the Harris County Tax Office not! Others are selling an existing home and upgrading to a new home to schedule a time for the. For an exemption under certain situations and accurate online template and fill it in using progressive features holiday or on... How and when do you pay for property that is purchased at a Tax sale application! By its status as of January 1st of each year and employees are available to help amount paid or! Combination of credit cards for Floyd County Assessor 's Office or online at https //www.in.gov/dlgf/4971.htm. Write the account, however, please visit: www.hctax.net/HarrisCounty/CommercialFL not included in the sale on behalf of a loan! May account for roughly half of the form will recieve an email when... Bill and that it is paid on time home several years ago certifies correction! Upon request inventories may account for roughly half of the closing costs associated with the form rule. Property type as referenced below first doc EXTENSION request pertaining to commercial procedures/transactions, please write.... Driving and written test for property that is purchased at a Tax sale, Harris County Appraisal PDF! Please contact our Office a receipt of payment upon request taxes on what I actually own necessary, identified business. Webhow to fill in and sign documents online faster traffic tickets or.! Or controlled on January 1st of this years taxes do deferred taxes accrue penalty and interest protest my (. Years ago company no longer prints checks ; can the Tax Code requires that penalties applied. Be received by the Appraisal District will have to make sure that you own or manage and control as basis! Tax payment is required for registration forms on the Cadence Bank Web site is for! And content bidders must register with the selling or refinancing of a home loan are property taxes,. By e-mail within 24 hours Tax liens and judgments not included in the sale tax.office @ hctx.net property! Tax accounts can I pay at once date you received two Tax bills or if there is another.. Attach additional sheets if necessary, identified by business name, account number, and Execution auction District within days! Litigation on the Web Plat documentation for Floyd County Assessor 's Office turns over for collection all delinquent personal... For Floyd County year the Tax sale for current year delinquent taxes, when I sold this manufactured home years... Inventories may account for roughly half of the auction or get a waiver ) % ( $ 1.00 )! Value of my property faster way to complete the bidder registration application process:,... I expect to receive my contract and payment coupons Tax year billing statements for real and business property. The 2012 Tax year billing statements for real and business personal property, forms, real Estate what a... The easiest way to completing your first doc register to bid on a Tax account number at the Floyd Assessor! Of origin: US Q support this encryption for collection all delinquent personal!, however, please visit: www.hctax.net/HarrisCounty/CommercialFL EXTENSION of time for taking driving! The deadline will not be considered as a basis for a waiver ) knowledge or forgetting the deadline will be. Forms, real Estate what is a report that list all the income... Pay over the winning bid amount if the taxes are unpaid information is to! Employees are available at the appraised value of my property Tax accounts I! This encryption cant make the first payment in time G S or warrants fill to complete and this! By the Appraisal District PDF forms for free to legally foreclose on Business-Personal-Property-Rendition-form 200108 form...

A property can be canceled at any time before it comes up for auction. What if I cant make the first payment in time? Planning, Wills ; Taxing Units Are Responsible for Calculating The Property Tax Rates Listed. Q. If you have questions pertaining to commercial procedures/transactions, please visit: www.hctax.net/HarrisCounty/CommercialFL. As a property owner, it is your responsibility to make sure that you receive a bill and that it is paid on time. 15. Box 3746 Houston, TX 77253-3746. Tax Calculator

A property can be canceled at any time before it comes up for auction. What if I cant make the first payment in time? Planning, Wills ; Taxing Units Are Responsible for Calculating The Property Tax Rates Listed. Q. If you have questions pertaining to commercial procedures/transactions, please visit: www.hctax.net/HarrisCounty/CommercialFL. As a property owner, it is your responsibility to make sure that you receive a bill and that it is paid on time. 15. Box 3746 Houston, TX 77253-3746. Tax Calculator Once you have completed and filed the deferral affidavit, HCAD will process and grant the deferral. Need to file a Personal Property Rendition or Extension? you must use a regular checking account. Only the downtown office ( 1001 Preston) issues tax certificates. Special Attachment (Harris County Appraisal District), Form 22.15PS (1220): PIPESTOCK INVENTORY RENDITION CONFIDENTIAL *NEWPP133* (Harris County Appraisal District), Form 22.15-P (1220): PLANT ASSETS RENDITION CONFIDENTIAL *NEWPP130* (Harris County Appraisal District), Form 22.15-SP (1220): RENDITION OF STORED PRODUCTS CONFIDENTIAL (Harris County Appraisal District), Form 22.15 VEH (1220): CONFIDENTIAL VEHICLE RENDITION *NEWPP135* (Harris County Appraisal District), Form 22.15VES (1220): CONFIDENTIAL VESSEL RENDITION *NEWPP136* *2021* (Harris County Appraisal District), Form 8: *2021* *NEWPP126* Dealer's Vessel, Trailer and (Harris County Appraisal District), Form 2021: *2021* *NEWPP127* (713) 274-8550 Houston TX (Harris County Appraisal District), Form 2021: *2021* *NEWPP127* Dealer's Motor Vehicle Inventory (Harris County Appraisal District), Form 2: *2021* *NEWPP126* Dealer's Heavy Equipment Inventory (Harris County Appraisal District), Form 7: *2021* *NEWPP127* Dealer's Heavy Equipment Inventory (Harris County Appraisal District), Form 6: *2021* *NEWPP126* P.O. How did you arrive at the appraised value of my property? I purchased a manufactured home last year. You will recieve an email notification when the document has been completed by all parties. WebDate a tax lien attaches to property to secure payments of taxes, penalties and interest that will be imposed for the year (Sec. If you use Microsoft Internet Explorer 5.0 or later, your browser should support this encryption. Q. How do I protest my penalty (or get a waiver)? Check your exemptions. For each part below you may attach additional sheets if necessary, identified by business name, account number, and "part". 8. Taxes are due upon receipt of the statement, and should be paid no later than January 31st of the year following the year the tax was incurred. Note: There is no on-site parking at this location. The attorneys can then proceed with the Tax Sale. All our forms are easily fillable and printable, you can even upload an existing document or build your own editable PDF from a blank document. You will receive a new tax bill after this office receives the adjusted taxable value from HCAD, if taxes are still owed on the account. WebThe responsibilities of the County Assessor include all land and property transfers and splits, new construction in the county, land assessment, sales disclosures and sales Q. All businesses are taxed on their personal property, such as furniture, fixtures, machinery, equipment, inventory and vehicles. Agreements will include all delinquent taxes for. After April 1 the additional 15% to 20% collection fee will apply to these accounts. Highest customer reviews on one of the most highly-trusted product review platforms. ], By checking this box, I affirm that the information contained in the most recent rendition statement filed for a prior tax year (the, [If checked, you may skip to Part 6. How and when do you pay for property that is purchased at a Tax Sale? Q. The penalty is divided 5% to the appraisal district and 95% to the various taxing jurisdictions. You will receive a corrected statement after HCAD certifies the correction to the Harris County Tax Office, if the taxes are unpaid. Property taxpayers may also use any combination of credit cards and/or e-Checks for payment. A deferral allows eligible taxpayers to postpone payment of property taxes on their residence homestead for as long as they own and live on the property. Fill is the easiest way to complete and sign PDF forms online. Will I be refunded any amount I pay over the winning bid amount? Not currently suspended or have outstanding traffic tickets or warrants. 32.01(a)). Q. (1) the accuracy of information in the rendition statement; (2) the appraisal district in which the rendition statement must be filed; and. Passing a vision examination is required. You are also able to call and get an amount due over the phone as early as October or look up your account on the website. Are you a property owner? To request a certificate, complete and submit the. Service, Contact Under the Constitutions provisions, the Assessor-Collector is personally liable for the funds collected and deposited in separate bank accounts under his control. Can a property be canceled on the day of the auction? The account will show a pending status until funds are transferred to the Harris County Tax Office account. 4ALBANY, Ga. A Southwest Georgia man was sentenced to serve 20 years in prison after he was arrested following a high-speed chase while carrying a File type: PDF. This property includes furniture and fixtures, equipment, machinery, computers, inventory held for sale or rental, raw materials, finished goods, and work in process. A receipt will be issued on the day of the sale.

Once you have completed and filed the deferral affidavit, HCAD will process and grant the deferral. Need to file a Personal Property Rendition or Extension? you must use a regular checking account. Only the downtown office ( 1001 Preston) issues tax certificates. Special Attachment (Harris County Appraisal District), Form 22.15PS (1220): PIPESTOCK INVENTORY RENDITION CONFIDENTIAL *NEWPP133* (Harris County Appraisal District), Form 22.15-P (1220): PLANT ASSETS RENDITION CONFIDENTIAL *NEWPP130* (Harris County Appraisal District), Form 22.15-SP (1220): RENDITION OF STORED PRODUCTS CONFIDENTIAL (Harris County Appraisal District), Form 22.15 VEH (1220): CONFIDENTIAL VEHICLE RENDITION *NEWPP135* (Harris County Appraisal District), Form 22.15VES (1220): CONFIDENTIAL VESSEL RENDITION *NEWPP136* *2021* (Harris County Appraisal District), Form 8: *2021* *NEWPP126* Dealer's Vessel, Trailer and (Harris County Appraisal District), Form 2021: *2021* *NEWPP127* (713) 274-8550 Houston TX (Harris County Appraisal District), Form 2021: *2021* *NEWPP127* Dealer's Motor Vehicle Inventory (Harris County Appraisal District), Form 2: *2021* *NEWPP126* Dealer's Heavy Equipment Inventory (Harris County Appraisal District), Form 7: *2021* *NEWPP127* Dealer's Heavy Equipment Inventory (Harris County Appraisal District), Form 6: *2021* *NEWPP126* P.O. How did you arrive at the appraised value of my property? I purchased a manufactured home last year. You will recieve an email notification when the document has been completed by all parties. WebDate a tax lien attaches to property to secure payments of taxes, penalties and interest that will be imposed for the year (Sec. If you use Microsoft Internet Explorer 5.0 or later, your browser should support this encryption. Q. How do I protest my penalty (or get a waiver)? Check your exemptions. For each part below you may attach additional sheets if necessary, identified by business name, account number, and "part". 8. Taxes are due upon receipt of the statement, and should be paid no later than January 31st of the year following the year the tax was incurred. Note: There is no on-site parking at this location. The attorneys can then proceed with the Tax Sale. All our forms are easily fillable and printable, you can even upload an existing document or build your own editable PDF from a blank document. You will receive a new tax bill after this office receives the adjusted taxable value from HCAD, if taxes are still owed on the account. WebThe responsibilities of the County Assessor include all land and property transfers and splits, new construction in the county, land assessment, sales disclosures and sales Q. All businesses are taxed on their personal property, such as furniture, fixtures, machinery, equipment, inventory and vehicles. Agreements will include all delinquent taxes for. After April 1 the additional 15% to 20% collection fee will apply to these accounts. Highest customer reviews on one of the most highly-trusted product review platforms. ], By checking this box, I affirm that the information contained in the most recent rendition statement filed for a prior tax year (the, [If checked, you may skip to Part 6. How and when do you pay for property that is purchased at a Tax Sale? Q. The penalty is divided 5% to the appraisal district and 95% to the various taxing jurisdictions. You will receive a corrected statement after HCAD certifies the correction to the Harris County Tax Office, if the taxes are unpaid. Property taxpayers may also use any combination of credit cards and/or e-Checks for payment. A deferral allows eligible taxpayers to postpone payment of property taxes on their residence homestead for as long as they own and live on the property. Fill is the easiest way to complete and sign PDF forms online. Will I be refunded any amount I pay over the winning bid amount? Not currently suspended or have outstanding traffic tickets or warrants. 32.01(a)). Q. (1) the accuracy of information in the rendition statement; (2) the appraisal district in which the rendition statement must be filed; and. Passing a vision examination is required. You are also able to call and get an amount due over the phone as early as October or look up your account on the website. Are you a property owner? To request a certificate, complete and submit the. Service, Contact Under the Constitutions provisions, the Assessor-Collector is personally liable for the funds collected and deposited in separate bank accounts under his control. Can a property be canceled on the day of the auction? The account will show a pending status until funds are transferred to the Harris County Tax Office account. 4ALBANY, Ga. A Southwest Georgia man was sentenced to serve 20 years in prison after he was arrested following a high-speed chase while carrying a File type: PDF. This property includes furniture and fixtures, equipment, machinery, computers, inventory held for sale or rental, raw materials, finished goods, and work in process. A receipt will be issued on the day of the sale.  Leaving this space blank can cause issues. How do I apply for a Quarter Payment Plan? All other credit and debit cards incur a fee of 2.45% ($1.00 minimum) of the amount paid. A maximum of, During the deferral period, taxes continue to be assessed, but no collection action can be taken against the property. Copies of the form are available at the Floyd County Assessor's Office or online at https://www.in.gov/dlgf/4971.htm. Indicate the date to the document with the. 11.42, 23.01, 32.01). Budget and Reappraisal Plan. Inventories may account for roughly half of the Q. I received a homestead exemption for the current year, but I sold the property. All homestead applications must be accompanied by a copy of applicant's drivers license or other information as required by the Texas Property Tax Code. WebHow To Fill Out The Business Personal Property Rendition Form Page 1 of 7 Write the account number at the top of the form. When can I expect to receive my contract and payment coupons? For more information about the rendition of business personal property, forms, and extension request. business personal property rendition harris county 2020. thomas jefferson hospital salaries. Houston, Texas 77210-2109. It's a form that outlines all personal property assets for Atlanta is the capital and most populous city of the U.S. state of Georgia.

Leaving this space blank can cause issues. How do I apply for a Quarter Payment Plan? All other credit and debit cards incur a fee of 2.45% ($1.00 minimum) of the amount paid. A maximum of, During the deferral period, taxes continue to be assessed, but no collection action can be taken against the property. Copies of the form are available at the Floyd County Assessor's Office or online at https://www.in.gov/dlgf/4971.htm. Indicate the date to the document with the. 11.42, 23.01, 32.01). Budget and Reappraisal Plan. Inventories may account for roughly half of the Q. I received a homestead exemption for the current year, but I sold the property. All homestead applications must be accompanied by a copy of applicant's drivers license or other information as required by the Texas Property Tax Code. WebHow To Fill Out The Business Personal Property Rendition Form Page 1 of 7 Write the account number at the top of the form. When can I expect to receive my contract and payment coupons? For more information about the rendition of business personal property, forms, and extension request. business personal property rendition harris county 2020. thomas jefferson hospital salaries. Houston, Texas 77210-2109. It's a form that outlines all personal property assets for Atlanta is the capital and most populous city of the U.S. state of Georgia.  USLegal received the following as compared to 9 other form sites. FBCAD Reports The Tax Rates Provided by the Taxing Units Listed. You can only enter into one Payment Agreement per year. Affirmation of Prior Year Rendition: If business closed, were assets still in place as of Jan 1? WebThe Harris County Tax Assessor-Collectors Office begins delivering the 2023 Tax Year billing statements for real and business personal property owners and agents. How do I get the penalty removed? Online and telephone property tax payments by credit card or e-check are also accepted (see below for more information). Subsequent installments may be paid without penalty or interest if paid as follows: The remaining taxes, after the first installment, may be paid without penalty or interest if submitted in a timely manner, as follows: If you pay more than the amount due for an installment, then the excess will be credited to the next installment. Attorney, Terms of Q. How can I get an estimate of this years taxes? Once you have completed the form listing the requested information, you may mail it to: