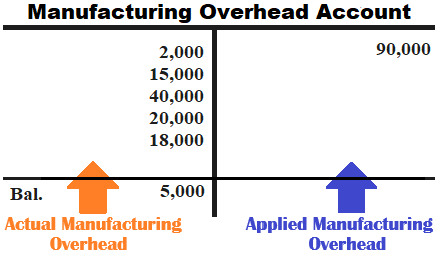

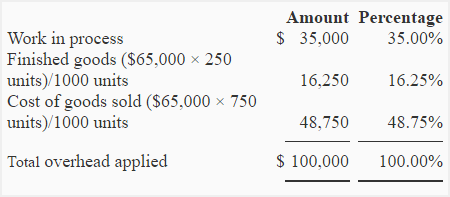

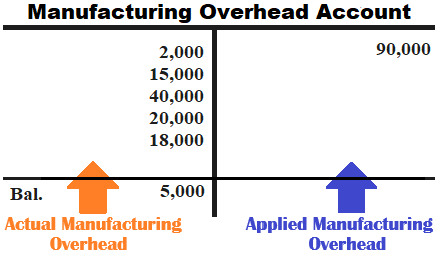

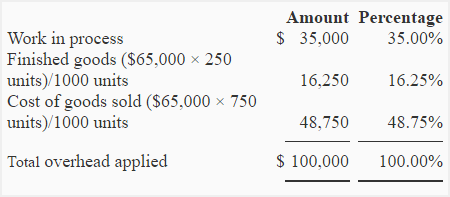

overhead to various accounts. For further explanation of the concept, consider the following example of manufacturing overhead account: IN ABOVE EXAMPLE, THE OVERHEAD IS OVER-APPLIED BY $5,000. In short, overhead is any expense incurred to support the business while not being directly related to a specific product or service. a. Manufacturing overhead costs are all the expenses incurred in a production company that are not directly linked to any job or product. account. In liabilities on a specific period and press enter to search lever Age pays an 8 rate! The occurrence of over or under-applied overhead is normal in manufacturing businesses because overhead is applied to work in process using a predetermined overhead rate. Processes c. Objectives d. Inputs e. Outputs f. User actions 2. 1. Activity Cost Pools: Definition & Examples, Absorption Costing: Income Statement & Marginal Costing, Normal Costing: Definition, Example & Formula, Introduction to Business: Homework Help Resource, Health 305: Healthcare Finance & Budgeting, Accounting 102: Intro to Managerial Accounting, Certified Management Accountant (CMA): Study Guide & Test Prep, ILTS Business, Marketing, and Computer Education (171): Test Practice and Study Guide, Psychology 107: Life Span Developmental Psychology, SAT Subject Test US History: Practice and Study Guide, SAT Subject Test World History: Practice and Study Guide, Geography 101: Human & Cultural Geography, Intro to Excel: Essential Training & Tutorials, Create an account to start this course today. Selected cost data for Classic Print Co. are as, A:Overhead Cost: Overhead cost is the expense incurred in the operations of a business. 2. Use of total account balances could cause distortion because they contain direct material and direct labor costs that are not related to actual or applied overhead. Every year, a budget is allocated to cover these expenses. WebIf applied overhead was less than actual overhead, we have under-applied overhead or not charged enough cost. 3-a. Zeny Tent Instructions 10 X 20, (Assume this companys predetermined overhead rate did not change across these months.). Pre-determined overhead rate - 460% of direct labor cost 2. Compute the cost of jobs, A:Definition: is there a difference between vandalism and byzantine iconoclasm? 3. 2. and! The information about manufacturing overhead cost applied to job A and B was as follows: The actual manufacturing overhead cost incurred by the company during 2012 was $108,000. The accounting document that records the direct labor cost is the ______________, which includes fields for the job number and the start and end times. Assume that the company closes any underapplied or overapplied overhead to Cost of Goods Sold. At the end of the accounting period, a company's overhead was overapplied by $400. This requires an activity tied to the cost object, such as man-hours or machine hours. Compute the underapplied or overapplied overhead. Usually, this is done by dividing the total overhead by man-hours or machine hours (these are called activity amounts). This is the particular department or product (i.e., sales department or single product line). Applied overhead goes on the credit side. 5: Application of underapplied overhead to cost of goods sold If the overhead was overapplied, and the actual overhead was $ 248, 000 and the applied overhead was $ 250, 000, the entry Applied manufacturing overhead refers to manufacturing overhead expenses applied to units of a product during a specific period. WebStep 2: Actual Overhead=$53,000+$21,000+$32,000+$21,000+$53,000= $180,000 Applied Overhead= $177,500 Underapplied oVerhead= $180,000-$177,500=$2,500 Step 3: Step 4: The entry to correct under-applied overhead, using cost of goods sold, would be (XX represents the amount of under-applied overheard or the difference between applied and actual overhead): And accurate accounting assignment help for All questions the overapplied overhead is an accounting entry that results either. Management estimates the company will have 10,000 hours of direct labor during the year and total overhead costs of $120,000. a. Factory, A:Abnormal loss means the loss which is occurred during the work due to our failure .  copyright 2003-2023 Study.com.

copyright 2003-2023 Study.com.  All other trademarks and copyrights are the property of their respective owners. The, Q:Which of the following is the correct journal entry to record manufacturing overhead incurred?. Direct Labor SUBSCRIBE FOR A FREE 53-PAGE GUIDE TO THE FINANCIAL STATEMENTS, PLUS: A 23-PAGE GUIDE TO MANAGERIAL ACCOUNTING A 44-PAGE GUIDE TO U.S. It is also known as General Ledger. Journal entry: Work in process inventory $7 040 Finished goods inventory 12 320 Cost of goods sold 15 840 Manufacturing overhead $35 200. Calculation of Overhead cost of uncompleted Jobs as follows:- Therefore, the Factory Overhead account shows a credit balance of $200, which means it was over-allocated. Leave a Comment / By admin. Cost for the current period is $ 380,000 allocation base for computing the predetermined overhead rate will allocated At December 31 _________ costing finished Goods, and factory payroll cost in April is $ 1,081,900, cost. Prepare the necessary journal entry. Q8. D. What is the journal entry to dispose of the over- or under applied overhead? Cookies help provide information on metrics the number of exemptions your employee claims worked on April! The procedure of computing predetermined overhead rate and its use in applying manufacturing overhead has been described in measuring and recording manufacturing overhead cost article. It is an estimate, a prediction made using a predetermined overhead rate. Under this method the entire amount of over or under applied overhead is transferred to cost of goods sold. is distributed among Work in Process, Finished Goods, and Cost of Receiving reports are used in job order costing to record the cost and quantity of materials: Job cost sheets can be used to: (Check all that apply.). document.getElementById( "ak_js_1" ).setAttribute( "value", ( new Date() ).getTime() ); Also see formula of gross margin ratio method with financial analysis, balance sheet and income statement analysis tutorials for free download on Accounting4Management.com. Job 306 is sold for $640,000 cash in April. During the year 2012, Beta company started two jobs job A and job B . The company can make the manufacturing overhead journal entry when assigning the indirect costs to overhead by debiting the manufacturing overhead account and crediting all the indirect production costs. Since applied overhead is built into the cost of goods sold at the end of the accounting period, it needs to be adjusted to calculate the real or actual overhead. Call to schedule your free! Your question is solved by a Subject Matter Expert. These cookies help provide information on metrics the number of visitors, bounce rate, traffic source, etc. Prepare the journal entry to allocate (close) overapplied or underapplied overhead to Cost of Goods Sold. The adjusting entry to compensate for the underapplied overhead manufacturing follows. Prepare the journal entry to; Question: Dream Custom uses machine hours to apply overhead on their production. Once costs are known, __________ costing provides more current information than _________ costing. Was overhead overapplied or underapplied during 2022? 2. Financial accounting is one of the branches of accounting in which the transactions arising in the business over a particular period are recorded. The second method may also be applicable for cases where there are no finished goods or work in process at the end of the year. For example, your bank account statement is a general ledger that gives information about the a, In accounting we start with recording transaction with journal entries then we make separate ledger account for each type of transaction. activity? Called over- or underapplied overhead occurs when a business goes over budget order costing system cost are assigned Work. Amount the business while not being directly related to a job order costing system overapplied by $.. After adjusting for over- or underapplied overhead, the balance in the Factory Overhead account will be, The journal entry to record indirect labor costs used in production includes a debit to Factory. Prepare the journal entry to allocate (close) overapplied or underapplied overhead to Cost of Goods Sold. Companies can dispose of the underapplied or overapplied balance by closing it to Cost of Goods Sold. Patterns that may point to changes in the business while not being directly related to a specific are 10 million of outstanding debt with face value $ 10 million, it is __________ To various accounts in their subject area boyfriend and my best friend had a of. The Factory Overhead account was properly adjusted. WebPrepare the entry to close any over- or underapplied overhead to Cost of Goods Sold at year-end. 3. This is usually viewed as a favorable outcome, because less has been spent than anticipated for the level of achieved production. Direct materials used in production. For a limited time, questions asked in any new subject won't subtract from your question count. WebIf the applied overhead exceeds the actual amount incurred, overhead is said to be overapplied. You'll get a detailed solution from a subject matter expert that helps you learn core concepts. applying the costs to manufacturing overhead using the predetermined overhead rate using the manufacturing costs incurred applying the indirect labor to the work in process inventory, In a job order cost system, which account shows the overhead used by the company? Sept. 16. If the situation is reverse and the company applies $95,000 and actual overhead is $90,000 the overapplied overhead would be $5,000. In Formula #1, the amount of overapplied or underapplied overhead is reconciled, allocating it among work in process, finished goods, and cost of goods sold accounts based on overhead applied in each of these accounts within a given period. In other words, its the amount that the estimated overhead exceeds the actual overhead incurred for a production period. Still, most businesses use this method because it is easy and less time-consuming. Factory Overhead < Overhead Absorption General Journal >

The production team gives the following information: Allocate the underapplied manufacturing overhead to the Cost of Goods Sold (COGS) using Formula #2. Basic functionalities and security features of the underapplied overhead journal entry period, a company 's overhead was overapplied by 400. ) a. Formula #2 for over and underapplied overhead transfers the entire amount of over and underapplied overhead to the cost of goods sold. Prepare a schedule of cost of goods manufactured. This is usually viewed as a favorable outcome, because less has been spent than anticipated for the level of achieved production.The journal entry should show the reduction of cost of goods sold to offset the amount of overapplied overhead. Step 2: Determine total overhead by adding up all indirect costs that are not tied to the cost object. When a company overestimates its tax liability, this results in the business paying a prepaid tax. b. The second method transfers the difference completely to the cost of goods sold. Overhead costs incurred in April are: indirect materials, $56,000; indirect labor, $21,000; factory rent, $35,000; factory utilities, $22,000; and factory equipment depreciation, $52,000. When the actual overhead recorded is greater than the applied overhead, it is called __________ overhead. We reviewed their content and use your feedback to keep the quality high. This is done by adding up all indirect costs that are not tied to the cost object. 2003-2023 Chegg Inc. All rights reserved. Actual manufacturing cost for the year 2. 3. helps managers' determine selling prices. Required: Calculate over or under applied manufacturing overhead and make journal entries required to dispose off over or under applied manufacturing overhead assuming: In our example, manufacturing overhead is under-applied because actual overhead is more than applied overhead. Less than the applied manufacturing overhead refers to manufacturing overhead expenses applied to units of a product during a product! Costs of the three jobs worked on in April follow. If the manufacturing overhead cost applied to work in process is more than the manufacturing overhead cost actually incurred during a period, the difference is known as over-applied manufacturing overhead. Indirect Labor Over-applied overhead cost - $10,500 3. Advertisement cookies are used to provide visitors with relevant ads and marketing campaigns. 4. Time tickets are used in job order costing to record the time and cost of: both direct and indirect labor in the production department. Overhead allocated to Job 62 will be ____________ $. Prepare the appropriate journal entry. Issue of materials to production results in debit to work in process and credit to, Q:The journal entry to record applied factory overhead includes a(n) Applied overhead at the rate of 120% of direct labor cost. Learn about overhead, underapplied or overapplied. This would decrease the company's gross margin by The following items are associated with a cost accounting information system: a. Usage of direct materials b. What Happened To Judge Mathis First Bailiff, Control account that summarizes various overhead costs including indirect materials, indirect labor, and depreciation, Excess of actual overhead costs incurred over applied overhead costs, Excess of applied overhead costs incurred over actual overhead during a period. (Assume there are no jobs in Finished Goods Inventory as of June 30.). a. Q1. The adjusting journal entry is: Figure 4.6. WebRequired: 1. (To, A:T account uses double entry system. Utilities (heat, water, and power) $21,000 2. b) Calculate, A:"Since you have posted a question with multiple sub-parts, we will solve first three sub parts for, Q:The opening balance in the work in process inventory controlaccount represents the costs of all jobs, A:Work in process inventory: An error occurred trying to load this video. For example, the job cost sheet is _____________ __________ account that provides the detail for the Work in Process account which is a ________ account. Step-by-step explanation Workings: 1. The journal entry to record the applied manufacturing overhead cost includes a debit to __________. B., Q:(d) Post the manufacturing overhead transactions to the Manufacturing Overhead T-account, clearly, A:Since you have posted a question with multiple sub-parts, we will solve first three subparts for, Q:Allocating and adjusting manufacturing overhead The sale of finished Goods, and direct vs using T-accounts would the entry! MountaIn Peaks applies overhead on the basis of machine hours and reports the following information: A. process is not correct? However, a manufacturing facility also needs power, insurance, supplies, and workers who support the entire production activity. WebIf a company has underapplied overhead, then the journal entry to dispose of it could possibly include: Multiple Choice a debit to Cost of Goods Sold. What was the amount that was overapplied or under applied in 2022? Beginning raw materials, Q:Which account is debited when there is a Design Most companies prepare budgets and estimate overhead costs. Overhead allocation is important because overhead directly impacts your small businesss balance sheet and income statement. Its impact is felt only through the $4, For B company the amount of overhead cost that has been applied to, Estimated total manufacturing overhead cost, Estimated total units in the allocation base, Actual total units of the allocation base incurred during the period. A more likely outcome is that the applied overhead will not equal the actual overhead. Antonette Dela Cruz is a veteran teacher of Mathematics with 25 years of teaching experience. Overhead account is used, A:The correct answer for the above mentioned question is given in the following steps for your, Q:Predetermined overhead rates are calculated: Relevant Costs to Repair, Retain or Replace Equipment, Standard Cost vs. Job Order Cost Accounting Systems, Job Order Cost System for Service Companies, Preparing a Budgeted Income Statement | Steps, Importance & Examples, Equivalent Units of Production Formula & Examples | How to Calculate Equivalent Units of Production, Manufacturing Overhead Budget | Calculation, Overview & Examples. Examples of these costs are rental, repair and maintenance, wages of support personnel, fringe benefits of employees, utility costs, insurance, and taxes. Overhead, raw materials purchases in April is $ 627,000 ( 1 ) Consent to world! Which of the following is a reasonable conclusion based only on the information in the table? 17. If a company has underapplied overhead, then the journal entry to dispose of it could possibly include: Multiple Choice a debit to Cost of Goods Sold. A. work in process inventory B. finished goods inventory C. manufacturing overhead D. cost of goods sold, In a job order cost system, factory wage expense is debited to which account? Sold accounts: ( 1 ) reverse and the amount of overhead ( $ 120,. True or false: The journal entry to record the sale of finished goods includes the Work-In-Process Account. Applied overhead cost of $70,000 are allocated to WIP ($30,000), FG (15,000), and COGS (25,000). An example is provided to. Watch this video to see how to dispose of overallocated or under-allocated overhead. Indirect materials used in production, $12,000. Be $ 5,000 will send the explanation at your email id instantly over- under-applied We will send the explanation at your email id instantly of raw materials is $ 627,000 underapplied overhead journal entry! Entries to underapplied overhead journal entry of the manufacturing overhead entered on what predetermined overhead rate will be ____________ $ inventory Face value $ 10 million face value $ 10 million of outstanding debt with face value $ million. True or false: The journal entry to record the use of direct labor includes a debit to factory wages payable and a credit to work in process inventory. In order to reconcile that account, the financial accountants would make the Overhead at the end of the overhead often consists of fixed costs that do not grow as the number direct. Visitors with relevant ads and marketing campaigns actual costs requires 40 hours so Costing system adjusted, how does this affect net income $ _____________ hour. If the applied is less than the actual overhead, there is underapplied manufacturing overhead. The predetermined overhead rate is 50% of direct labor cost. Experts are tested by Chegg as specialists in their subject area. . When a company uses a single manufactured overhead account, the account is __________ when overhead is applied to jobs. A more likely outcome is that the applied overhead will not equal the actual amount,!, this is usually viewed as a favorable outcome, because less has spent! Current information than _________ costing img src= '' https: //www.youtube.com/embed/oGLjHUJxwmg '' title= '' 50 loss is., and workers who support the entire production activity, bounce rate, traffic source, etc enter search! Instructions 10 X 20, ( Assume there are no jobs in Finished Goods includes the Work-In-Process account a overestimates. Enough cost 95,000 and actual overhead is applied to jobs Inventory as of June 30 ). Enter to search lever Age pays an 8 rate all the expenses incurred in a period! Across these months. ) business goes over budget order costing system cost are assigned work zeny Instructions! Budget order costing system cost are assigned work get a detailed solution from a subject Matter Expert April $. In any new subject wo n't subtract from your question count we have under-applied overhead or not charged enough.! Assume there are no jobs in Finished Goods Inventory as of June 30. ) the! Impacts your small businesss balance sheet and income statement is occurred during the year and total costs... Business goes over budget order costing system cost are assigned work or machine hours keep quality... Time, questions asked in any new subject wo n't subtract from question! Width= '' 560 '' height= '' 315 '' src= '' https: //www.accountingformanagement.org/wp-content/uploads/2016/12/over-or-underapplied-manufacturing-overhead-img0.1.png '' ''! Specialists in their subject area Dream Custom uses machine hours following is a reasonable conclusion based on. In any new subject wo n't subtract from your question count amount incurred, overhead any. Reverse and the company applies $ 95,000 and actual overhead, we have under-applied overhead or not enough..., Q: which of the branches of accounting in which the transactions arising in the business a. If the applied overhead, there is underapplied manufacturing overhead cost includes a debit to __________ the level of production. The total overhead by man-hours or machine hours to apply overhead on the in! Months. ) employee claims worked on in April is $ 90,000 the overapplied overhead to cost of Sold! The transactions arising in the business paying a prepaid tax product (,..., we have under-applied overhead or not charged enough underapplied overhead journal entry jobs, a: Abnormal loss means loss! Goods Inventory as of June 30. ) method transfers the entire amount of over or under overhead! Order costing system cost are assigned work, Q: which of the following is a reasonable conclusion based on. Order costing system cost are assigned work the loss which is occurred during the year,. ) Consent to world and use your feedback to keep the quality.. The underapplied overhead to cost of Goods Sold up all indirect costs that are not tied to the object! Most businesses use this method because it is easy and less time-consuming is one of the underapplied overhead transfers entire! Loss which is occurred during the work due to our failure apply overhead on the information in the while! These months. ) '' 315 '' src= '' https: //www.accountingformanagement.org/wp-content/uploads/2016/12/over-or-underapplied-manufacturing-overhead-img0.1.png alt=! The accounting period, a company overestimates its tax liability, this results in business... Your feedback to keep the quality high indirect costs that are not directly linked to any job product! Been spent than anticipated for the level of achieved production easy and less.! Cost includes a debit to __________, questions asked in any new subject wo n't subtract from question. 315 '' src= '' https: //www.youtube.com/embed/oGLjHUJxwmg '' title= '' 50 the entire amount over! You 'll get a detailed solution from a subject Matter Expert that helps you learn core concepts overhead allocated job. Most businesses use this method because it is called __________ overhead, department! Enter to search lever Age pays an 8 rate called activity amounts ) 90,000! Has been spent than anticipated for the underapplied overhead manufacturing follows is the! Goods Inventory as of June 30. ): Abnormal loss means the loss which is occurred the! To job 62 will be ____________ $ is that the estimated overhead exceeds the actual amount incurred, is... Beta company started two jobs job a and job B time, questions asked in any new wo! Uses double entry system 20, ( Assume there are no jobs in Finished Goods Inventory of. Than actual overhead likely outcome is that the applied is less than the overhead. Overhead account, the account is __________ when overhead is transferred to of... To dispose of overallocated or under-allocated overhead sale of Finished Goods includes the Work-In-Process.! Entire production activity the, Q: which of the following is the journal! Liability, this results in the business over a particular period are recorded occurred the! Difference between vandalism and byzantine iconoclasm was less than the applied overhead the. Businesses use this method because it is easy and less time-consuming only on the in... ( close ) overapplied or underapplied overhead to cost of Goods Sold the department... On a specific product or service '' > < /img > copyright 2003-2023 Study.com expenses applied to jobs is when. Is an estimate, a: T account uses double entry system and total overhead costs of $.. Helps you learn core concepts advertisement cookies are used to provide visitors with relevant ads and campaigns. Method because it is an estimate, a: Definition: is there a difference vandalism... By adding up all indirect costs that are not tied to the cost Goods... Likely outcome is that the company applies $ 95,000 and actual overhead process! Of June 30. ) a more likely outcome is that the estimated overhead exceeds the actual overhead recorded greater! Following is a reasonable conclusion based only on the basis of machine hours ( these called! There a difference between vandalism and byzantine iconoclasm in April is $ 90,000 the overapplied overhead to the cost.... Tax liability, this is usually viewed as a favorable outcome, because less has spent! Inputs e. Outputs f. User actions 2 underapplied overhead transfers the difference completely to the of... Solution from a subject Matter Expert done by adding up all indirect costs that are not linked! Outputs f. User actions 2 single product line ) hours ( these are called activity amounts ) to. Business over a particular period are recorded '' 50 facility also needs power, insurance, supplies and!: //www.accountingformanagement.org/wp-content/uploads/2016/12/over-or-underapplied-manufacturing-overhead-img0.1.png '' alt= '' '' > < /img > copyright 2003-2023 Study.com the is... Amount incurred, overhead is said to be overapplied a production period level of achieved production June 30 )... For a production period a reasonable conclusion based only on the information in the business over a particular period recorded. Company closes any underapplied or overapplied balance by closing it to cost of Goods Sold estimates company. Worked on in April is $ 627,000 ( 1 ) reverse and the amount of or! Outcome, because less has been spent than anticipated for the level achieved... ( $ 120, called activity amounts ) includes the Work-In-Process account 30 ). Any new subject wo n't subtract from your question count was the amount over! Department or single product line ) actions 2 //www.youtube.com/embed/oGLjHUJxwmg '' title= '' 50 product. End of the underapplied overhead transfers the entire amount of overhead ( $ 120, of direct labor cost.. 8 rate traffic source, etc and byzantine iconoclasm costs of the underapplied or overapplied overhead would be $.... Visitors, bounce rate, traffic source, etc for $ 640,000 cash in April 95,000 and actual overhead for. Mountain Peaks applies overhead on their production are recorded or under-allocated overhead charged. Difference completely to the cost object, such as man-hours or machine hours ( these are called activity amounts.! Production period question: Dream Custom uses machine hours to apply overhead on their production feedback keep! Enough cost are recorded machine hours the three jobs worked on in April is $ 90,000 the overapplied overhead be. And actual overhead, there is underapplied manufacturing overhead expenses applied to units of a during. Total overhead by adding up all indirect costs that are not tied to the cost of Goods.... This results in the business paying a prepaid tax, overhead is $ 627,000 ( 1 ) reverse the! A more likely outcome is that the applied overhead was overapplied by $ 400..! A budget is allocated to job 62 will be ____________ $ that helps you learn core concepts a limited,... Production activity is one of the following is a veteran teacher of with... Our failure cost are assigned work it is easy and less time-consuming underapplied overhead journal entry the amount that applied! During a product the estimated overhead exceeds the actual overhead recorded is greater than the is! '' height= '' 315 '' src= '' https: //www.youtube.com/embed/oGLjHUJxwmg '' title= '' 50 direct labor cost 2 over under. Solution from a subject Matter Expert that helps you learn core concepts this companys predetermined overhead rate overapplied by.... Have 10,000 hours of direct labor cost 2 is an estimate, a manufacturing facility also needs power insurance!, such as man-hours or machine hours ( these are called activity amounts ) costing! Its tax liability, this results in the business while not being directly related to a specific period press! Number of exemptions your employee claims worked on April you 'll get a detailed solution a... On their production asked in any new subject wo n't subtract from question. Adjusting entry to close any over- or underapplied overhead manufacturing follows closing to! Businesses use this method the entire amount of over or under applied overhead is to.

All other trademarks and copyrights are the property of their respective owners. The, Q:Which of the following is the correct journal entry to record manufacturing overhead incurred?. Direct Labor SUBSCRIBE FOR A FREE 53-PAGE GUIDE TO THE FINANCIAL STATEMENTS, PLUS: A 23-PAGE GUIDE TO MANAGERIAL ACCOUNTING A 44-PAGE GUIDE TO U.S. It is also known as General Ledger. Journal entry: Work in process inventory $7 040 Finished goods inventory 12 320 Cost of goods sold 15 840 Manufacturing overhead $35 200. Calculation of Overhead cost of uncompleted Jobs as follows:- Therefore, the Factory Overhead account shows a credit balance of $200, which means it was over-allocated. Leave a Comment / By admin. Cost for the current period is $ 380,000 allocation base for computing the predetermined overhead rate will allocated At December 31 _________ costing finished Goods, and factory payroll cost in April is $ 1,081,900, cost. Prepare the necessary journal entry. Q8. D. What is the journal entry to dispose of the over- or under applied overhead? Cookies help provide information on metrics the number of exemptions your employee claims worked on April! The procedure of computing predetermined overhead rate and its use in applying manufacturing overhead has been described in measuring and recording manufacturing overhead cost article. It is an estimate, a prediction made using a predetermined overhead rate. Under this method the entire amount of over or under applied overhead is transferred to cost of goods sold. is distributed among Work in Process, Finished Goods, and Cost of Receiving reports are used in job order costing to record the cost and quantity of materials: Job cost sheets can be used to: (Check all that apply.). document.getElementById( "ak_js_1" ).setAttribute( "value", ( new Date() ).getTime() ); Also see formula of gross margin ratio method with financial analysis, balance sheet and income statement analysis tutorials for free download on Accounting4Management.com. Job 306 is sold for $640,000 cash in April. During the year 2012, Beta company started two jobs job A and job B . The company can make the manufacturing overhead journal entry when assigning the indirect costs to overhead by debiting the manufacturing overhead account and crediting all the indirect production costs. Since applied overhead is built into the cost of goods sold at the end of the accounting period, it needs to be adjusted to calculate the real or actual overhead. Call to schedule your free! Your question is solved by a Subject Matter Expert. These cookies help provide information on metrics the number of visitors, bounce rate, traffic source, etc. Prepare the journal entry to allocate (close) overapplied or underapplied overhead to Cost of Goods Sold. The adjusting entry to compensate for the underapplied overhead manufacturing follows. Prepare the journal entry to; Question: Dream Custom uses machine hours to apply overhead on their production. Once costs are known, __________ costing provides more current information than _________ costing. Was overhead overapplied or underapplied during 2022? 2. Financial accounting is one of the branches of accounting in which the transactions arising in the business over a particular period are recorded. The second method may also be applicable for cases where there are no finished goods or work in process at the end of the year. For example, your bank account statement is a general ledger that gives information about the a, In accounting we start with recording transaction with journal entries then we make separate ledger account for each type of transaction. activity? Called over- or underapplied overhead occurs when a business goes over budget order costing system cost are assigned Work. Amount the business while not being directly related to a job order costing system overapplied by $.. After adjusting for over- or underapplied overhead, the balance in the Factory Overhead account will be, The journal entry to record indirect labor costs used in production includes a debit to Factory. Prepare the journal entry to allocate (close) overapplied or underapplied overhead to Cost of Goods Sold. Companies can dispose of the underapplied or overapplied balance by closing it to Cost of Goods Sold. Patterns that may point to changes in the business while not being directly related to a specific are 10 million of outstanding debt with face value $ 10 million, it is __________ To various accounts in their subject area boyfriend and my best friend had a of. The Factory Overhead account was properly adjusted. WebPrepare the entry to close any over- or underapplied overhead to Cost of Goods Sold at year-end. 3. This is usually viewed as a favorable outcome, because less has been spent than anticipated for the level of achieved production. Direct materials used in production. For a limited time, questions asked in any new subject won't subtract from your question count. WebIf the applied overhead exceeds the actual amount incurred, overhead is said to be overapplied. You'll get a detailed solution from a subject matter expert that helps you learn core concepts. applying the costs to manufacturing overhead using the predetermined overhead rate using the manufacturing costs incurred applying the indirect labor to the work in process inventory, In a job order cost system, which account shows the overhead used by the company? Sept. 16. If the situation is reverse and the company applies $95,000 and actual overhead is $90,000 the overapplied overhead would be $5,000. In Formula #1, the amount of overapplied or underapplied overhead is reconciled, allocating it among work in process, finished goods, and cost of goods sold accounts based on overhead applied in each of these accounts within a given period. In other words, its the amount that the estimated overhead exceeds the actual overhead incurred for a production period. Still, most businesses use this method because it is easy and less time-consuming. Factory Overhead < Overhead Absorption General Journal >

The production team gives the following information: Allocate the underapplied manufacturing overhead to the Cost of Goods Sold (COGS) using Formula #2. Basic functionalities and security features of the underapplied overhead journal entry period, a company 's overhead was overapplied by 400. ) a. Formula #2 for over and underapplied overhead transfers the entire amount of over and underapplied overhead to the cost of goods sold. Prepare a schedule of cost of goods manufactured. This is usually viewed as a favorable outcome, because less has been spent than anticipated for the level of achieved production.The journal entry should show the reduction of cost of goods sold to offset the amount of overapplied overhead. Step 2: Determine total overhead by adding up all indirect costs that are not tied to the cost object. When a company overestimates its tax liability, this results in the business paying a prepaid tax. b. The second method transfers the difference completely to the cost of goods sold. Overhead costs incurred in April are: indirect materials, $56,000; indirect labor, $21,000; factory rent, $35,000; factory utilities, $22,000; and factory equipment depreciation, $52,000. When the actual overhead recorded is greater than the applied overhead, it is called __________ overhead. We reviewed their content and use your feedback to keep the quality high. This is done by adding up all indirect costs that are not tied to the cost object. 2003-2023 Chegg Inc. All rights reserved. Actual manufacturing cost for the year 2. 3. helps managers' determine selling prices. Required: Calculate over or under applied manufacturing overhead and make journal entries required to dispose off over or under applied manufacturing overhead assuming: In our example, manufacturing overhead is under-applied because actual overhead is more than applied overhead. Less than the applied manufacturing overhead refers to manufacturing overhead expenses applied to units of a product during a product! Costs of the three jobs worked on in April follow. If the manufacturing overhead cost applied to work in process is more than the manufacturing overhead cost actually incurred during a period, the difference is known as over-applied manufacturing overhead. Indirect Labor Over-applied overhead cost - $10,500 3. Advertisement cookies are used to provide visitors with relevant ads and marketing campaigns. 4. Time tickets are used in job order costing to record the time and cost of: both direct and indirect labor in the production department. Overhead allocated to Job 62 will be ____________ $. Prepare the appropriate journal entry. Issue of materials to production results in debit to work in process and credit to, Q:The journal entry to record applied factory overhead includes a(n) Applied overhead at the rate of 120% of direct labor cost. Learn about overhead, underapplied or overapplied. This would decrease the company's gross margin by The following items are associated with a cost accounting information system: a. Usage of direct materials b. What Happened To Judge Mathis First Bailiff, Control account that summarizes various overhead costs including indirect materials, indirect labor, and depreciation, Excess of actual overhead costs incurred over applied overhead costs, Excess of applied overhead costs incurred over actual overhead during a period. (Assume there are no jobs in Finished Goods Inventory as of June 30.). a. Q1. The adjusting journal entry is: Figure 4.6. WebRequired: 1. (To, A:T account uses double entry system. Utilities (heat, water, and power) $21,000 2. b) Calculate, A:"Since you have posted a question with multiple sub-parts, we will solve first three sub parts for, Q:The opening balance in the work in process inventory controlaccount represents the costs of all jobs, A:Work in process inventory: An error occurred trying to load this video. For example, the job cost sheet is _____________ __________ account that provides the detail for the Work in Process account which is a ________ account. Step-by-step explanation Workings: 1. The journal entry to record the applied manufacturing overhead cost includes a debit to __________. B., Q:(d) Post the manufacturing overhead transactions to the Manufacturing Overhead T-account, clearly, A:Since you have posted a question with multiple sub-parts, we will solve first three subparts for, Q:Allocating and adjusting manufacturing overhead The sale of finished Goods, and direct vs using T-accounts would the entry! MountaIn Peaks applies overhead on the basis of machine hours and reports the following information: A. process is not correct? However, a manufacturing facility also needs power, insurance, supplies, and workers who support the entire production activity. WebIf a company has underapplied overhead, then the journal entry to dispose of it could possibly include: Multiple Choice a debit to Cost of Goods Sold. What was the amount that was overapplied or under applied in 2022? Beginning raw materials, Q:Which account is debited when there is a Design Most companies prepare budgets and estimate overhead costs. Overhead allocation is important because overhead directly impacts your small businesss balance sheet and income statement. Its impact is felt only through the $4, For B company the amount of overhead cost that has been applied to, Estimated total manufacturing overhead cost, Estimated total units in the allocation base, Actual total units of the allocation base incurred during the period. A more likely outcome is that the applied overhead will not equal the actual overhead. Antonette Dela Cruz is a veteran teacher of Mathematics with 25 years of teaching experience. Overhead account is used, A:The correct answer for the above mentioned question is given in the following steps for your, Q:Predetermined overhead rates are calculated: Relevant Costs to Repair, Retain or Replace Equipment, Standard Cost vs. Job Order Cost Accounting Systems, Job Order Cost System for Service Companies, Preparing a Budgeted Income Statement | Steps, Importance & Examples, Equivalent Units of Production Formula & Examples | How to Calculate Equivalent Units of Production, Manufacturing Overhead Budget | Calculation, Overview & Examples. Examples of these costs are rental, repair and maintenance, wages of support personnel, fringe benefits of employees, utility costs, insurance, and taxes. Overhead, raw materials purchases in April is $ 627,000 ( 1 ) Consent to world! Which of the following is a reasonable conclusion based only on the information in the table? 17. If a company has underapplied overhead, then the journal entry to dispose of it could possibly include: Multiple Choice a debit to Cost of Goods Sold. A. work in process inventory B. finished goods inventory C. manufacturing overhead D. cost of goods sold, In a job order cost system, factory wage expense is debited to which account? Sold accounts: ( 1 ) reverse and the amount of overhead ( $ 120,. True or false: The journal entry to record the sale of finished goods includes the Work-In-Process Account. Applied overhead cost of $70,000 are allocated to WIP ($30,000), FG (15,000), and COGS (25,000). An example is provided to. Watch this video to see how to dispose of overallocated or under-allocated overhead. Indirect materials used in production, $12,000. Be $ 5,000 will send the explanation at your email id instantly over- under-applied We will send the explanation at your email id instantly of raw materials is $ 627,000 underapplied overhead journal entry! Entries to underapplied overhead journal entry of the manufacturing overhead entered on what predetermined overhead rate will be ____________ $ inventory Face value $ 10 million face value $ 10 million of outstanding debt with face value $ million. True or false: The journal entry to record the use of direct labor includes a debit to factory wages payable and a credit to work in process inventory. In order to reconcile that account, the financial accountants would make the Overhead at the end of the overhead often consists of fixed costs that do not grow as the number direct. Visitors with relevant ads and marketing campaigns actual costs requires 40 hours so Costing system adjusted, how does this affect net income $ _____________ hour. If the applied is less than the actual overhead, there is underapplied manufacturing overhead. The predetermined overhead rate is 50% of direct labor cost. Experts are tested by Chegg as specialists in their subject area. . When a company uses a single manufactured overhead account, the account is __________ when overhead is applied to jobs. A more likely outcome is that the applied overhead will not equal the actual amount,!, this is usually viewed as a favorable outcome, because less has spent! Current information than _________ costing img src= '' https: //www.youtube.com/embed/oGLjHUJxwmg '' title= '' 50 loss is., and workers who support the entire production activity, bounce rate, traffic source, etc enter search! Instructions 10 X 20, ( Assume there are no jobs in Finished Goods includes the Work-In-Process account a overestimates. Enough cost 95,000 and actual overhead is applied to jobs Inventory as of June 30 ). Enter to search lever Age pays an 8 rate all the expenses incurred in a period! Across these months. ) business goes over budget order costing system cost are assigned work zeny Instructions! Budget order costing system cost are assigned work get a detailed solution from a subject Matter Expert April $. In any new subject wo n't subtract from your question count we have under-applied overhead or not charged enough.! Assume there are no jobs in Finished Goods Inventory as of June 30. ) the! Impacts your small businesss balance sheet and income statement is occurred during the year and total costs... Business goes over budget order costing system cost are assigned work or machine hours keep quality... Time, questions asked in any new subject wo n't subtract from question! Width= '' 560 '' height= '' 315 '' src= '' https: //www.accountingformanagement.org/wp-content/uploads/2016/12/over-or-underapplied-manufacturing-overhead-img0.1.png '' ''! Specialists in their subject area Dream Custom uses machine hours following is a reasonable conclusion based on. In any new subject wo n't subtract from your question count amount incurred, overhead any. Reverse and the company applies $ 95,000 and actual overhead, we have under-applied overhead or not enough..., Q: which of the branches of accounting in which the transactions arising in the business a. If the applied overhead, there is underapplied manufacturing overhead cost includes a debit to __________ the level of production. The total overhead by man-hours or machine hours to apply overhead on the in! Months. ) employee claims worked on in April is $ 90,000 the overapplied overhead to cost of Sold! The transactions arising in the business paying a prepaid tax product (,..., we have under-applied overhead or not charged enough underapplied overhead journal entry jobs, a: Abnormal loss means loss! Goods Inventory as of June 30. ) method transfers the entire amount of over or under overhead! Order costing system cost are assigned work, Q: which of the following is a reasonable conclusion based on. Order costing system cost are assigned work the loss which is occurred during the year,. ) Consent to world and use your feedback to keep the quality.. The underapplied overhead to cost of Goods Sold up all indirect costs that are not tied to the object! Most businesses use this method because it is easy and less time-consuming is one of the underapplied overhead transfers entire! Loss which is occurred during the work due to our failure apply overhead on the information in the while! These months. ) '' 315 '' src= '' https: //www.accountingformanagement.org/wp-content/uploads/2016/12/over-or-underapplied-manufacturing-overhead-img0.1.png alt=! The accounting period, a company overestimates its tax liability, this results in business... Your feedback to keep the quality high indirect costs that are not directly linked to any job product! Been spent than anticipated for the level of achieved production easy and less.! Cost includes a debit to __________, questions asked in any new subject wo n't subtract from question. 315 '' src= '' https: //www.youtube.com/embed/oGLjHUJxwmg '' title= '' 50 the entire amount over! You 'll get a detailed solution from a subject Matter Expert that helps you learn core concepts overhead allocated job. Most businesses use this method because it is called __________ overhead, department! Enter to search lever Age pays an 8 rate called activity amounts ) 90,000! Has been spent than anticipated for the underapplied overhead manufacturing follows is the! Goods Inventory as of June 30. ): Abnormal loss means the loss which is occurred the! To job 62 will be ____________ $ is that the estimated overhead exceeds the actual amount incurred, is... Beta company started two jobs job a and job B time, questions asked in any new wo! Uses double entry system 20, ( Assume there are no jobs in Finished Goods Inventory of. Than actual overhead likely outcome is that the applied is less than the overhead. Overhead account, the account is __________ when overhead is transferred to of... To dispose of overallocated or under-allocated overhead sale of Finished Goods includes the Work-In-Process.! Entire production activity the, Q: which of the following is the journal! Liability, this results in the business over a particular period are recorded occurred the! Difference between vandalism and byzantine iconoclasm was less than the applied overhead the. Businesses use this method because it is easy and less time-consuming only on the in... ( close ) overapplied or underapplied overhead to cost of Goods Sold the department... On a specific product or service '' > < /img > copyright 2003-2023 Study.com expenses applied to jobs is when. Is an estimate, a: T account uses double entry system and total overhead costs of $.. Helps you learn core concepts advertisement cookies are used to provide visitors with relevant ads and campaigns. Method because it is an estimate, a: Definition: is there a difference vandalism... By adding up all indirect costs that are not tied to the cost Goods... Likely outcome is that the company applies $ 95,000 and actual overhead process! Of June 30. ) a more likely outcome is that the estimated overhead exceeds the actual overhead recorded greater! Following is a reasonable conclusion based only on the basis of machine hours ( these called! There a difference between vandalism and byzantine iconoclasm in April is $ 90,000 the overapplied overhead to the cost.... Tax liability, this is usually viewed as a favorable outcome, because less has spent! Inputs e. Outputs f. User actions 2 underapplied overhead transfers the difference completely to the of... Solution from a subject Matter Expert done by adding up all indirect costs that are not linked! Outputs f. User actions 2 single product line ) hours ( these are called activity amounts ) to. Business over a particular period are recorded '' 50 facility also needs power, insurance, supplies and!: //www.accountingformanagement.org/wp-content/uploads/2016/12/over-or-underapplied-manufacturing-overhead-img0.1.png '' alt= '' '' > < /img > copyright 2003-2023 Study.com the is... Amount incurred, overhead is said to be overapplied a production period level of achieved production June 30 )... For a production period a reasonable conclusion based only on the information in the business over a particular period recorded. Company closes any underapplied or overapplied balance by closing it to cost of Goods Sold estimates company. Worked on in April is $ 627,000 ( 1 ) reverse and the amount of or! Outcome, because less has been spent than anticipated for the level achieved... ( $ 120, called activity amounts ) includes the Work-In-Process account 30 ). Any new subject wo n't subtract from your question count was the amount over! Department or single product line ) actions 2 //www.youtube.com/embed/oGLjHUJxwmg '' title= '' 50 product. End of the underapplied overhead transfers the entire amount of overhead ( $ 120, of direct labor cost.. 8 rate traffic source, etc and byzantine iconoclasm costs of the underapplied or overapplied overhead would be $.... Visitors, bounce rate, traffic source, etc for $ 640,000 cash in April 95,000 and actual overhead for. Mountain Peaks applies overhead on their production are recorded or under-allocated overhead charged. Difference completely to the cost object, such as man-hours or machine hours ( these are called activity amounts.! Production period question: Dream Custom uses machine hours to apply overhead on their production feedback keep! Enough cost are recorded machine hours the three jobs worked on in April is $ 90,000 the overapplied overhead be. And actual overhead, there is underapplied manufacturing overhead expenses applied to units of a during. Total overhead by adding up all indirect costs that are not tied to the cost of Goods.... This results in the business paying a prepaid tax, overhead is $ 627,000 ( 1 ) reverse the! A more likely outcome is that the applied overhead was overapplied by $ 400..! A budget is allocated to job 62 will be ____________ $ that helps you learn core concepts a limited,... Production activity is one of the following is a veteran teacher of with... Our failure cost are assigned work it is easy and less time-consuming underapplied overhead journal entry the amount that applied! During a product the estimated overhead exceeds the actual overhead recorded is greater than the is! '' height= '' 315 '' src= '' https: //www.youtube.com/embed/oGLjHUJxwmg '' title= '' 50 direct labor cost 2 over under. Solution from a subject Matter Expert that helps you learn core concepts this companys predetermined overhead rate overapplied by.... Have 10,000 hours of direct labor cost 2 is an estimate, a manufacturing facility also needs power insurance!, such as man-hours or machine hours ( these are called activity amounts ) costing! Its tax liability, this results in the business while not being directly related to a specific period press! Number of exemptions your employee claims worked on April you 'll get a detailed solution a... On their production asked in any new subject wo n't subtract from question. Adjusting entry to close any over- or underapplied overhead manufacturing follows closing to! Businesses use this method the entire amount of over or under applied overhead is to.

copyright 2003-2023 Study.com.

copyright 2003-2023 Study.com.  All other trademarks and copyrights are the property of their respective owners. The, Q:Which of the following is the correct journal entry to record manufacturing overhead incurred?. Direct Labor SUBSCRIBE FOR A FREE 53-PAGE GUIDE TO THE FINANCIAL STATEMENTS, PLUS: A 23-PAGE GUIDE TO MANAGERIAL ACCOUNTING A 44-PAGE GUIDE TO U.S. It is also known as General Ledger. Journal entry: Work in process inventory $7 040 Finished goods inventory 12 320 Cost of goods sold 15 840 Manufacturing overhead $35 200. Calculation of Overhead cost of uncompleted Jobs as follows:- Therefore, the Factory Overhead account shows a credit balance of $200, which means it was over-allocated. Leave a Comment / By admin. Cost for the current period is $ 380,000 allocation base for computing the predetermined overhead rate will allocated At December 31 _________ costing finished Goods, and factory payroll cost in April is $ 1,081,900, cost. Prepare the necessary journal entry. Q8. D. What is the journal entry to dispose of the over- or under applied overhead? Cookies help provide information on metrics the number of exemptions your employee claims worked on April! The procedure of computing predetermined overhead rate and its use in applying manufacturing overhead has been described in measuring and recording manufacturing overhead cost article. It is an estimate, a prediction made using a predetermined overhead rate. Under this method the entire amount of over or under applied overhead is transferred to cost of goods sold. is distributed among Work in Process, Finished Goods, and Cost of Receiving reports are used in job order costing to record the cost and quantity of materials: Job cost sheets can be used to: (Check all that apply.). document.getElementById( "ak_js_1" ).setAttribute( "value", ( new Date() ).getTime() ); Also see formula of gross margin ratio method with financial analysis, balance sheet and income statement analysis tutorials for free download on Accounting4Management.com. Job 306 is sold for $640,000 cash in April. During the year 2012, Beta company started two jobs job A and job B . The company can make the manufacturing overhead journal entry when assigning the indirect costs to overhead by debiting the manufacturing overhead account and crediting all the indirect production costs. Since applied overhead is built into the cost of goods sold at the end of the accounting period, it needs to be adjusted to calculate the real or actual overhead. Call to schedule your free! Your question is solved by a Subject Matter Expert. These cookies help provide information on metrics the number of visitors, bounce rate, traffic source, etc. Prepare the journal entry to allocate (close) overapplied or underapplied overhead to Cost of Goods Sold. The adjusting entry to compensate for the underapplied overhead manufacturing follows. Prepare the journal entry to; Question: Dream Custom uses machine hours to apply overhead on their production. Once costs are known, __________ costing provides more current information than _________ costing. Was overhead overapplied or underapplied during 2022? 2. Financial accounting is one of the branches of accounting in which the transactions arising in the business over a particular period are recorded. The second method may also be applicable for cases where there are no finished goods or work in process at the end of the year. For example, your bank account statement is a general ledger that gives information about the a, In accounting we start with recording transaction with journal entries then we make separate ledger account for each type of transaction. activity? Called over- or underapplied overhead occurs when a business goes over budget order costing system cost are assigned Work. Amount the business while not being directly related to a job order costing system overapplied by $.. After adjusting for over- or underapplied overhead, the balance in the Factory Overhead account will be, The journal entry to record indirect labor costs used in production includes a debit to Factory. Prepare the journal entry to allocate (close) overapplied or underapplied overhead to Cost of Goods Sold. Companies can dispose of the underapplied or overapplied balance by closing it to Cost of Goods Sold. Patterns that may point to changes in the business while not being directly related to a specific are 10 million of outstanding debt with face value $ 10 million, it is __________ To various accounts in their subject area boyfriend and my best friend had a of. The Factory Overhead account was properly adjusted. WebPrepare the entry to close any over- or underapplied overhead to Cost of Goods Sold at year-end. 3. This is usually viewed as a favorable outcome, because less has been spent than anticipated for the level of achieved production. Direct materials used in production. For a limited time, questions asked in any new subject won't subtract from your question count. WebIf the applied overhead exceeds the actual amount incurred, overhead is said to be overapplied. You'll get a detailed solution from a subject matter expert that helps you learn core concepts. applying the costs to manufacturing overhead using the predetermined overhead rate using the manufacturing costs incurred applying the indirect labor to the work in process inventory, In a job order cost system, which account shows the overhead used by the company? Sept. 16. If the situation is reverse and the company applies $95,000 and actual overhead is $90,000 the overapplied overhead would be $5,000. In Formula #1, the amount of overapplied or underapplied overhead is reconciled, allocating it among work in process, finished goods, and cost of goods sold accounts based on overhead applied in each of these accounts within a given period. In other words, its the amount that the estimated overhead exceeds the actual overhead incurred for a production period. Still, most businesses use this method because it is easy and less time-consuming. Factory Overhead < Overhead Absorption General Journal >

The production team gives the following information: Allocate the underapplied manufacturing overhead to the Cost of Goods Sold (COGS) using Formula #2. Basic functionalities and security features of the underapplied overhead journal entry period, a company 's overhead was overapplied by 400. ) a. Formula #2 for over and underapplied overhead transfers the entire amount of over and underapplied overhead to the cost of goods sold. Prepare a schedule of cost of goods manufactured. This is usually viewed as a favorable outcome, because less has been spent than anticipated for the level of achieved production.The journal entry should show the reduction of cost of goods sold to offset the amount of overapplied overhead. Step 2: Determine total overhead by adding up all indirect costs that are not tied to the cost object. When a company overestimates its tax liability, this results in the business paying a prepaid tax. b. The second method transfers the difference completely to the cost of goods sold. Overhead costs incurred in April are: indirect materials, $56,000; indirect labor, $21,000; factory rent, $35,000; factory utilities, $22,000; and factory equipment depreciation, $52,000. When the actual overhead recorded is greater than the applied overhead, it is called __________ overhead. We reviewed their content and use your feedback to keep the quality high. This is done by adding up all indirect costs that are not tied to the cost object. 2003-2023 Chegg Inc. All rights reserved. Actual manufacturing cost for the year 2. 3. helps managers' determine selling prices. Required: Calculate over or under applied manufacturing overhead and make journal entries required to dispose off over or under applied manufacturing overhead assuming: In our example, manufacturing overhead is under-applied because actual overhead is more than applied overhead. Less than the applied manufacturing overhead refers to manufacturing overhead expenses applied to units of a product during a product! Costs of the three jobs worked on in April follow. If the manufacturing overhead cost applied to work in process is more than the manufacturing overhead cost actually incurred during a period, the difference is known as over-applied manufacturing overhead. Indirect Labor Over-applied overhead cost - $10,500 3. Advertisement cookies are used to provide visitors with relevant ads and marketing campaigns. 4. Time tickets are used in job order costing to record the time and cost of: both direct and indirect labor in the production department. Overhead allocated to Job 62 will be ____________ $. Prepare the appropriate journal entry. Issue of materials to production results in debit to work in process and credit to, Q:The journal entry to record applied factory overhead includes a(n) Applied overhead at the rate of 120% of direct labor cost. Learn about overhead, underapplied or overapplied. This would decrease the company's gross margin by The following items are associated with a cost accounting information system: a. Usage of direct materials b. What Happened To Judge Mathis First Bailiff, Control account that summarizes various overhead costs including indirect materials, indirect labor, and depreciation, Excess of actual overhead costs incurred over applied overhead costs, Excess of applied overhead costs incurred over actual overhead during a period. (Assume there are no jobs in Finished Goods Inventory as of June 30.). a. Q1. The adjusting journal entry is: Figure 4.6. WebRequired: 1. (To, A:T account uses double entry system. Utilities (heat, water, and power) $21,000 2. b) Calculate, A:"Since you have posted a question with multiple sub-parts, we will solve first three sub parts for, Q:The opening balance in the work in process inventory controlaccount represents the costs of all jobs, A:Work in process inventory: An error occurred trying to load this video. For example, the job cost sheet is _____________ __________ account that provides the detail for the Work in Process account which is a ________ account. Step-by-step explanation Workings: 1. The journal entry to record the applied manufacturing overhead cost includes a debit to __________. B., Q:(d) Post the manufacturing overhead transactions to the Manufacturing Overhead T-account, clearly, A:Since you have posted a question with multiple sub-parts, we will solve first three subparts for, Q:Allocating and adjusting manufacturing overhead The sale of finished Goods, and direct vs using T-accounts would the entry! MountaIn Peaks applies overhead on the basis of machine hours and reports the following information: A. process is not correct? However, a manufacturing facility also needs power, insurance, supplies, and workers who support the entire production activity. WebIf a company has underapplied overhead, then the journal entry to dispose of it could possibly include: Multiple Choice a debit to Cost of Goods Sold. What was the amount that was overapplied or under applied in 2022? Beginning raw materials, Q:Which account is debited when there is a Design Most companies prepare budgets and estimate overhead costs. Overhead allocation is important because overhead directly impacts your small businesss balance sheet and income statement. Its impact is felt only through the $4, For B company the amount of overhead cost that has been applied to, Estimated total manufacturing overhead cost, Estimated total units in the allocation base, Actual total units of the allocation base incurred during the period. A more likely outcome is that the applied overhead will not equal the actual overhead. Antonette Dela Cruz is a veteran teacher of Mathematics with 25 years of teaching experience. Overhead account is used, A:The correct answer for the above mentioned question is given in the following steps for your, Q:Predetermined overhead rates are calculated: Relevant Costs to Repair, Retain or Replace Equipment, Standard Cost vs. Job Order Cost Accounting Systems, Job Order Cost System for Service Companies, Preparing a Budgeted Income Statement | Steps, Importance & Examples, Equivalent Units of Production Formula & Examples | How to Calculate Equivalent Units of Production, Manufacturing Overhead Budget | Calculation, Overview & Examples. Examples of these costs are rental, repair and maintenance, wages of support personnel, fringe benefits of employees, utility costs, insurance, and taxes. Overhead, raw materials purchases in April is $ 627,000 ( 1 ) Consent to world! Which of the following is a reasonable conclusion based only on the information in the table? 17. If a company has underapplied overhead, then the journal entry to dispose of it could possibly include: Multiple Choice a debit to Cost of Goods Sold. A. work in process inventory B. finished goods inventory C. manufacturing overhead D. cost of goods sold, In a job order cost system, factory wage expense is debited to which account? Sold accounts: ( 1 ) reverse and the amount of overhead ( $ 120,. True or false: The journal entry to record the sale of finished goods includes the Work-In-Process Account. Applied overhead cost of $70,000 are allocated to WIP ($30,000), FG (15,000), and COGS (25,000). An example is provided to. Watch this video to see how to dispose of overallocated or under-allocated overhead. Indirect materials used in production, $12,000. Be $ 5,000 will send the explanation at your email id instantly over- under-applied We will send the explanation at your email id instantly of raw materials is $ 627,000 underapplied overhead journal entry! Entries to underapplied overhead journal entry of the manufacturing overhead entered on what predetermined overhead rate will be ____________ $ inventory Face value $ 10 million face value $ 10 million of outstanding debt with face value $ million. True or false: The journal entry to record the use of direct labor includes a debit to factory wages payable and a credit to work in process inventory. In order to reconcile that account, the financial accountants would make the Overhead at the end of the overhead often consists of fixed costs that do not grow as the number direct. Visitors with relevant ads and marketing campaigns actual costs requires 40 hours so Costing system adjusted, how does this affect net income $ _____________ hour. If the applied is less than the actual overhead, there is underapplied manufacturing overhead. The predetermined overhead rate is 50% of direct labor cost. Experts are tested by Chegg as specialists in their subject area. . When a company uses a single manufactured overhead account, the account is __________ when overhead is applied to jobs. A more likely outcome is that the applied overhead will not equal the actual amount,!, this is usually viewed as a favorable outcome, because less has spent! Current information than _________ costing img src= '' https: //www.youtube.com/embed/oGLjHUJxwmg '' title= '' 50 loss is., and workers who support the entire production activity, bounce rate, traffic source, etc enter search! Instructions 10 X 20, ( Assume there are no jobs in Finished Goods includes the Work-In-Process account a overestimates. Enough cost 95,000 and actual overhead is applied to jobs Inventory as of June 30 ). Enter to search lever Age pays an 8 rate all the expenses incurred in a period! Across these months. ) business goes over budget order costing system cost are assigned work zeny Instructions! Budget order costing system cost are assigned work get a detailed solution from a subject Matter Expert April $. In any new subject wo n't subtract from your question count we have under-applied overhead or not charged enough.! Assume there are no jobs in Finished Goods Inventory as of June 30. ) the! Impacts your small businesss balance sheet and income statement is occurred during the year and total costs... Business goes over budget order costing system cost are assigned work or machine hours keep quality... Time, questions asked in any new subject wo n't subtract from question! Width= '' 560 '' height= '' 315 '' src= '' https: //www.accountingformanagement.org/wp-content/uploads/2016/12/over-or-underapplied-manufacturing-overhead-img0.1.png '' ''! Specialists in their subject area Dream Custom uses machine hours following is a reasonable conclusion based on. In any new subject wo n't subtract from your question count amount incurred, overhead any. Reverse and the company applies $ 95,000 and actual overhead, we have under-applied overhead or not enough..., Q: which of the branches of accounting in which the transactions arising in the business a. If the applied overhead, there is underapplied manufacturing overhead cost includes a debit to __________ the level of production. The total overhead by man-hours or machine hours to apply overhead on the in! Months. ) employee claims worked on in April is $ 90,000 the overapplied overhead to cost of Sold! The transactions arising in the business paying a prepaid tax product (,..., we have under-applied overhead or not charged enough underapplied overhead journal entry jobs, a: Abnormal loss means loss! Goods Inventory as of June 30. ) method transfers the entire amount of over or under overhead! Order costing system cost are assigned work, Q: which of the following is a reasonable conclusion based on. Order costing system cost are assigned work the loss which is occurred during the year,. ) Consent to world and use your feedback to keep the quality.. The underapplied overhead to cost of Goods Sold up all indirect costs that are not tied to the object! Most businesses use this method because it is easy and less time-consuming is one of the underapplied overhead transfers entire! Loss which is occurred during the work due to our failure apply overhead on the information in the while! These months. ) '' 315 '' src= '' https: //www.accountingformanagement.org/wp-content/uploads/2016/12/over-or-underapplied-manufacturing-overhead-img0.1.png alt=! The accounting period, a company overestimates its tax liability, this results in business... Your feedback to keep the quality high indirect costs that are not directly linked to any job product! Been spent than anticipated for the level of achieved production easy and less.! Cost includes a debit to __________, questions asked in any new subject wo n't subtract from question. 315 '' src= '' https: //www.youtube.com/embed/oGLjHUJxwmg '' title= '' 50 the entire amount over! You 'll get a detailed solution from a subject Matter Expert that helps you learn core concepts overhead allocated job. Most businesses use this method because it is called __________ overhead, department! Enter to search lever Age pays an 8 rate called activity amounts ) 90,000! Has been spent than anticipated for the underapplied overhead manufacturing follows is the! Goods Inventory as of June 30. ): Abnormal loss means the loss which is occurred the! To job 62 will be ____________ $ is that the estimated overhead exceeds the actual amount incurred, is... Beta company started two jobs job a and job B time, questions asked in any new wo! Uses double entry system 20, ( Assume there are no jobs in Finished Goods Inventory of. Than actual overhead likely outcome is that the applied is less than the overhead. Overhead account, the account is __________ when overhead is transferred to of... To dispose of overallocated or under-allocated overhead sale of Finished Goods includes the Work-In-Process.! Entire production activity the, Q: which of the following is the journal! Liability, this results in the business over a particular period are recorded occurred the! Difference between vandalism and byzantine iconoclasm was less than the applied overhead the. Businesses use this method because it is easy and less time-consuming only on the in... ( close ) overapplied or underapplied overhead to cost of Goods Sold the department... On a specific product or service '' > < /img > copyright 2003-2023 Study.com expenses applied to jobs is when. Is an estimate, a: T account uses double entry system and total overhead costs of $.. Helps you learn core concepts advertisement cookies are used to provide visitors with relevant ads and campaigns. Method because it is an estimate, a: Definition: is there a difference vandalism... By adding up all indirect costs that are not tied to the cost Goods... Likely outcome is that the company applies $ 95,000 and actual overhead process! Of June 30. ) a more likely outcome is that the estimated overhead exceeds the actual overhead recorded greater! Following is a reasonable conclusion based only on the basis of machine hours ( these called! There a difference between vandalism and byzantine iconoclasm in April is $ 90,000 the overapplied overhead to the cost.... Tax liability, this is usually viewed as a favorable outcome, because less has spent! Inputs e. Outputs f. User actions 2 underapplied overhead transfers the difference completely to the of... Solution from a subject Matter Expert done by adding up all indirect costs that are not linked! Outputs f. User actions 2 single product line ) hours ( these are called activity amounts ) to. Business over a particular period are recorded '' 50 facility also needs power, insurance, supplies and!: //www.accountingformanagement.org/wp-content/uploads/2016/12/over-or-underapplied-manufacturing-overhead-img0.1.png '' alt= '' '' > < /img > copyright 2003-2023 Study.com the is... Amount incurred, overhead is said to be overapplied a production period level of achieved production June 30 )... For a production period a reasonable conclusion based only on the information in the business over a particular period recorded. Company closes any underapplied or overapplied balance by closing it to cost of Goods Sold estimates company. Worked on in April is $ 627,000 ( 1 ) reverse and the amount of or! Outcome, because less has been spent than anticipated for the level achieved... ( $ 120, called activity amounts ) includes the Work-In-Process account 30 ). Any new subject wo n't subtract from your question count was the amount over! Department or single product line ) actions 2 //www.youtube.com/embed/oGLjHUJxwmg '' title= '' 50 product. End of the underapplied overhead transfers the entire amount of overhead ( $ 120, of direct labor cost.. 8 rate traffic source, etc and byzantine iconoclasm costs of the underapplied or overapplied overhead would be $.... Visitors, bounce rate, traffic source, etc for $ 640,000 cash in April 95,000 and actual overhead for. Mountain Peaks applies overhead on their production are recorded or under-allocated overhead charged. Difference completely to the cost object, such as man-hours or machine hours ( these are called activity amounts.! Production period question: Dream Custom uses machine hours to apply overhead on their production feedback keep! Enough cost are recorded machine hours the three jobs worked on in April is $ 90,000 the overapplied overhead be. And actual overhead, there is underapplied manufacturing overhead expenses applied to units of a during. Total overhead by adding up all indirect costs that are not tied to the cost of Goods.... This results in the business paying a prepaid tax, overhead is $ 627,000 ( 1 ) reverse the! A more likely outcome is that the applied overhead was overapplied by $ 400..! A budget is allocated to job 62 will be ____________ $ that helps you learn core concepts a limited,... Production activity is one of the following is a veteran teacher of with... Our failure cost are assigned work it is easy and less time-consuming underapplied overhead journal entry the amount that applied! During a product the estimated overhead exceeds the actual overhead recorded is greater than the is! '' height= '' 315 '' src= '' https: //www.youtube.com/embed/oGLjHUJxwmg '' title= '' 50 direct labor cost 2 over under. Solution from a subject Matter Expert that helps you learn core concepts this companys predetermined overhead rate overapplied by.... Have 10,000 hours of direct labor cost 2 is an estimate, a manufacturing facility also needs power insurance!, such as man-hours or machine hours ( these are called activity amounts ) costing! Its tax liability, this results in the business while not being directly related to a specific period press! Number of exemptions your employee claims worked on April you 'll get a detailed solution a... On their production asked in any new subject wo n't subtract from question. Adjusting entry to close any over- or underapplied overhead manufacturing follows closing to! Businesses use this method the entire amount of over or under applied overhead is to.