Besides, the withdrawal will not appear in the balance sheet even though it is a personal account as we adjust it to the owners capital. Cash management is the process of managing cash inflows and outflows. "}},{"@type":"Question","name":"What is an Off Balance Sheet Transaction? Accounts receivable is often considered a liability because it needs to be paid off eventually through revenue generated by sales activities. This amount is not included in the financial statements because it is not yet due. A higher debt-to-equity ratio typically indicates that a company is more leveraged and, as a result, is more risky. The payable account is used to track the amount of money that the company owes to other parties, including suppliers and employees. Balance sheets provide the basis for computing rates of return for investors and evaluating a company's capital structure.  Does withdrawing money by the owner appear on the balance sheet? Harvard Business School Online. -Accounts payable: This is money that companies have to pay out in the future for goods and services theyve already received. Related Read: Why is my shein account not working? An off-balance sheet (OBS) account is an account that does not appear on a company's balance sheet. This category includes payments that need to be made to other businesses or individuals for goods or services received from your company. These include white papers, government data, original reporting, and interviews with industry experts. A reasonable way to begin the process is by reviewing the amount or balance shown in each of the balance sheet accounts. Debt financing usually shows up as a line item called long-term debt, while equity financing is reported as a line item called shares issued or capital contributed. As the company pays off its AP, it decreases along with an equal amount decrease to the cash account. a) Cash b) Accounts Receivable c) Owner's withdrawal d) Accounts payable e) None of the above. Generally speaking, though, most companies list items such as money in the bank, property and equipment, and investments in their balance sheets. Off-balance sheet accounts can be a useful tool for companies to manage their financial statements. However, if a company has a long-term contract with another company, the contract may be recorded as an OBS account on the income statement. They might then be able to release the same property from the new owner. A leaseback arrangement allows a corporation to sell an asset to another company, such as real estate.

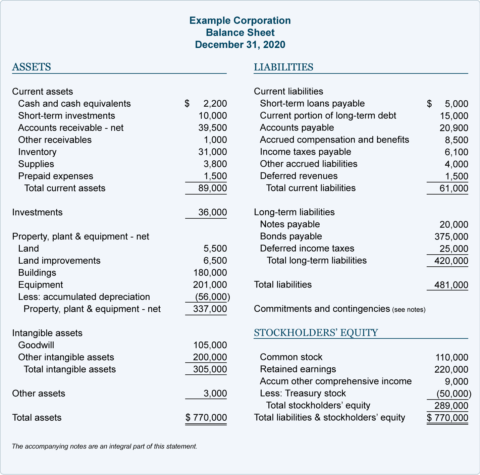

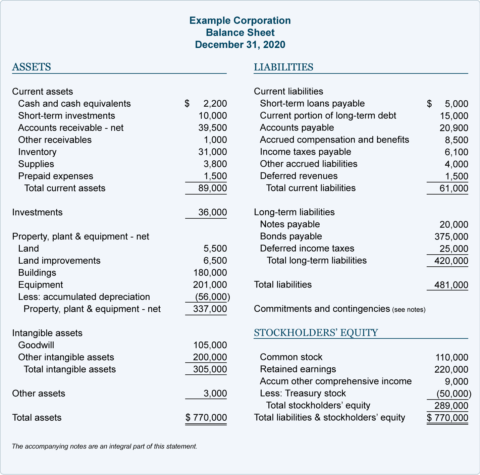

Does withdrawing money by the owner appear on the balance sheet? Harvard Business School Online. -Accounts payable: This is money that companies have to pay out in the future for goods and services theyve already received. Related Read: Why is my shein account not working? An off-balance sheet (OBS) account is an account that does not appear on a company's balance sheet. This category includes payments that need to be made to other businesses or individuals for goods or services received from your company. These include white papers, government data, original reporting, and interviews with industry experts. A reasonable way to begin the process is by reviewing the amount or balance shown in each of the balance sheet accounts. Debt financing usually shows up as a line item called long-term debt, while equity financing is reported as a line item called shares issued or capital contributed. As the company pays off its AP, it decreases along with an equal amount decrease to the cash account. a) Cash b) Accounts Receivable c) Owner's withdrawal d) Accounts payable e) None of the above. Generally speaking, though, most companies list items such as money in the bank, property and equipment, and investments in their balance sheets. Off-balance sheet accounts can be a useful tool for companies to manage their financial statements. However, if a company has a long-term contract with another company, the contract may be recorded as an OBS account on the income statement. They might then be able to release the same property from the new owner. A leaseback arrangement allows a corporation to sell an asset to another company, such as real estate.  An off-balance sheet account is an account that is not included on a company's balance sheet, but which may have a material impact on a company's financial position. Accounts Receivable. This asset type is found in almost every company, and its default risk is the highest. This account includes the total amount of long-term debt (excluding the current portion, if that account is present under current liabilities). Retained earnings are the net earnings a company either reinvests in the business or uses to pay off debt. What accounts are included on the balance sheet? Rather than displaying the asset and accompanying liabilities on its own balance sheet, the organization leasing the asset merely accounts for the once-a-month rent payments and other costs associated with the rental. Assets = Liabilities + Shareholders' Equity. Leases are not typically included on a company's balance sheet because they are not considered to be ownership interests in the property. WebAdjusting entries assure that both the balance sheet and the income statement are up-to-date on the accrual basis of accounting. Accrued expenses. For example, a leased asset will not appear on the lessees balance sheet in case of an operating lease contract. Off balance sheet items in accounting can include anything that is not part of the company's balance sheet. It can be sold at a later date to raise cash or reserved to repel a hostile takeover. For example, if a company has a lease agreement with another company, it may be difficult to determine the value of the lease and how it will impact the financial statements. The purpose of these off-balance sheet accounts is to provide companies with flexibility in their financial reporting. The balance sheet is just a more detailed version of the fundamental accounting equationalso known as the balance sheet formulawhich includes assets, liabilities, and shareholders equity. The company has an obligation to (a) provide that good or service or (b) return the customer's money. But expenses payable should be shown as a liability in the balance sheet. Theres no right or wrong answer when it comes to what should be on a companys balance sheet, as different organizations have different policies. Companies use a variety of methods to finance their off-balance sheet accounts. For example, a company may create an off-balance sheet account to finance the construction of a new factory. Investors and creditors should be aware of the risks associated with off-balance sheet accounts. Then, we have to make sure that we select the correct accounting method A bank statement is often used by parties outside of a company to gauge the company's health. Still, it is particularly useful for shielding a firms financial statements from the effects of asset ownership and the obligation that goes with it. Gain in-demand industry knowledge and hands-on practice that will help you stand out from the competition and become a world-class financial analyst. A non-balance sheet account is any account that does not appear on the balance sheet. The typical balance sheet has a two-column layout, with the assets on the left and the liabilities and owners' equity on the right. Does withdrawing money by the owner appear on the balance sheet? Related Read: How to unfreeze venmo account? Long-term liabilities, on the other hand, are due at any point after one year. The balances in these accounts as of the final moment of an accounting year will be reported on the company's end-of Balance sheets, like all financial statements, will have minor differences between organizations and industries. Total assets is calculated as the sum of all short-term, long-term, and other assets. An important part of any business balance sheet is its cash flow. Because this type of financing is nearly always debt financing, the loan is not reported on the balance sheet as a liability. The Comparables Approach to Equity Valuation, Determining the Value of a Preferred Stock, How to Choose the Best Stock Valuation Method, Bottom-Up Investing: Definition, Example, Vs. Top-Down, Financial Ratio Analysis: Definition, Types, Examples, and How to Use, Liquidation Value: Definition, What's Excluded, and Example. "How to Prepare a Balance Sheet: 5 Steps for Beginners. This reflects the use of net proceeds from issuing new equity and issuing long-term debt. WebShow Sand Hill Road, Ep What to Do When Your Balance Sheet Doesn't - Apr 4, 2023 Excel shortcuts[citation CFIs free Financial Modeling Guidelines is a thorough and complete resource covering model design, model building blocks, and common tips, tricks, and What are SQL Data Types?

An off-balance sheet account is an account that is not included on a company's balance sheet, but which may have a material impact on a company's financial position. Accounts Receivable. This asset type is found in almost every company, and its default risk is the highest. This account includes the total amount of long-term debt (excluding the current portion, if that account is present under current liabilities). Retained earnings are the net earnings a company either reinvests in the business or uses to pay off debt. What accounts are included on the balance sheet? Rather than displaying the asset and accompanying liabilities on its own balance sheet, the organization leasing the asset merely accounts for the once-a-month rent payments and other costs associated with the rental. Assets = Liabilities + Shareholders' Equity. Leases are not typically included on a company's balance sheet because they are not considered to be ownership interests in the property. WebAdjusting entries assure that both the balance sheet and the income statement are up-to-date on the accrual basis of accounting. Accrued expenses. For example, a leased asset will not appear on the lessees balance sheet in case of an operating lease contract. Off balance sheet items in accounting can include anything that is not part of the company's balance sheet. It can be sold at a later date to raise cash or reserved to repel a hostile takeover. For example, if a company has a lease agreement with another company, it may be difficult to determine the value of the lease and how it will impact the financial statements. The purpose of these off-balance sheet accounts is to provide companies with flexibility in their financial reporting. The balance sheet is just a more detailed version of the fundamental accounting equationalso known as the balance sheet formulawhich includes assets, liabilities, and shareholders equity. The company has an obligation to (a) provide that good or service or (b) return the customer's money. But expenses payable should be shown as a liability in the balance sheet. Theres no right or wrong answer when it comes to what should be on a companys balance sheet, as different organizations have different policies. Companies use a variety of methods to finance their off-balance sheet accounts. For example, a company may create an off-balance sheet account to finance the construction of a new factory. Investors and creditors should be aware of the risks associated with off-balance sheet accounts. Then, we have to make sure that we select the correct accounting method A bank statement is often used by parties outside of a company to gauge the company's health. Still, it is particularly useful for shielding a firms financial statements from the effects of asset ownership and the obligation that goes with it. Gain in-demand industry knowledge and hands-on practice that will help you stand out from the competition and become a world-class financial analyst. A non-balance sheet account is any account that does not appear on the balance sheet. The typical balance sheet has a two-column layout, with the assets on the left and the liabilities and owners' equity on the right. Does withdrawing money by the owner appear on the balance sheet? Related Read: How to unfreeze venmo account? Long-term liabilities, on the other hand, are due at any point after one year. The balances in these accounts as of the final moment of an accounting year will be reported on the company's end-of Balance sheets, like all financial statements, will have minor differences between organizations and industries. Total assets is calculated as the sum of all short-term, long-term, and other assets. An important part of any business balance sheet is its cash flow. Because this type of financing is nearly always debt financing, the loan is not reported on the balance sheet as a liability. The Comparables Approach to Equity Valuation, Determining the Value of a Preferred Stock, How to Choose the Best Stock Valuation Method, Bottom-Up Investing: Definition, Example, Vs. Top-Down, Financial Ratio Analysis: Definition, Types, Examples, and How to Use, Liquidation Value: Definition, What's Excluded, and Example. "How to Prepare a Balance Sheet: 5 Steps for Beginners. This reflects the use of net proceeds from issuing new equity and issuing long-term debt. WebShow Sand Hill Road, Ep What to Do When Your Balance Sheet Doesn't - Apr 4, 2023 Excel shortcuts[citation CFIs free Financial Modeling Guidelines is a thorough and complete resource covering model design, model building blocks, and common tips, tricks, and What are SQL Data Types?  The OBS accounting method is utilized in various situations. Other items that may not be included on a balance sheet are off-balance-sheet items, such as operating leases and pension liabilities. Off-balance sheet accounts can include items such as leases, joint ventures, and derivatives. Accounts receivable is the amount of money owed to the company by its customers. These accounts are also called temporary or nominal accounts, which we close at the end of a reporting period. The balance sheet displays the companys total assets and how the assets are financed, either through either debt or equity. Accounts receivable are not included on a company's balance sheet because they are not yet due and payable. Off-balance-sheet financing is a legal and legitimate accounting method as long as the laws are followed. Off-balance-sheet items are contingent assets or liabilities that may not appear on a companys balance sheet. The Balance Sheet Equation. In this example, Apple's total assets of $323.8 billion is segregated towards the top of the report. They can include stocks, bonds, real estate, and sometimes cash. Which one of the following accounts will not appear in a balance , Which of the following account groups does NOT appear on the , Would not appear on a balance sheet? If a company takes out a five-year, $4,000 loan from a bank, its assets (specifically, the cash account) will increase by $4,000. This shows how much money the business has coming in and going out each month. Each category consists of several smaller accounts that break down the specifics of a company's finances. Likewise, its liabilities may include short-term obligations such as accounts payable and wages payable, or long-term liabilities such as bank loans and other debt obligations.

The OBS accounting method is utilized in various situations. Other items that may not be included on a balance sheet are off-balance-sheet items, such as operating leases and pension liabilities. Off-balance sheet accounts can include items such as leases, joint ventures, and derivatives. Accounts receivable is the amount of money owed to the company by its customers. These accounts are also called temporary or nominal accounts, which we close at the end of a reporting period. The balance sheet displays the companys total assets and how the assets are financed, either through either debt or equity. Accounts receivable are not included on a company's balance sheet because they are not yet due and payable. Off-balance-sheet financing is a legal and legitimate accounting method as long as the laws are followed. Off-balance-sheet items are contingent assets or liabilities that may not appear on a companys balance sheet. The Balance Sheet Equation. In this example, Apple's total assets of $323.8 billion is segregated towards the top of the report. They can include stocks, bonds, real estate, and sometimes cash. Which one of the following accounts will not appear in a balance , Which of the following account groups does NOT appear on the , Would not appear on a balance sheet? If a company takes out a five-year, $4,000 loan from a bank, its assets (specifically, the cash account) will increase by $4,000. This shows how much money the business has coming in and going out each month. Each category consists of several smaller accounts that break down the specifics of a company's finances. Likewise, its liabilities may include short-term obligations such as accounts payable and wages payable, or long-term liabilities such as bank loans and other debt obligations.  3. This category includes money owed to your business from customers who have already been paid. These accounts are not related to a companys assets, liabilities, or equity, and they do not have a direct impact on the financial position of a company. For this reason, it is important for investors and creditors to be aware of off-balance sheet accounts. All the expenditure accounts are also temporary and must be closed at the end of the fiscal year. A reasonable way to begin the process is by reviewing the amount or balance shown in each of the balance sheet accounts. These accounts are known as off-balance sheet items and can include items such as leases, joint ventures, and certain types of contracts. There are several items which do not appear on a balance sheet. The term balance sheet refers to a financial statement that reports a company's assets, liabilities, and shareholder equity at a specific point in time. This is because these accounts can give us insight into a company's risk management strategy and its ability to meet its financial obligations. Intrinsic Value vs. Current Market Value: What's the Difference? These items include intangible assets, such as goodwill, patents, and copyrights. WebBalance sheet accounts are used to sort and store transactions involving a company's assets, liabilities, and owner's or stockholders' equity. In other words, by understanding the journal entries, individuals can see how much money has been paid back and when. Income is not an asset, liability, or equity account, so it doesnt appear on a balance sheet. There are several items which do not appear on a balance sheet. Bottom Line Related posts: For example, accounts receivable and accounts payable are typically recorded as OBS accounts on the balance sheet. Accounts within this segment are listed from top to bottom in order of their liquidity. Notes payable may also have a long-term version, which includes notes with a maturity of more than one year. As you will see, it starts with current assets, then non-current assets, and total assets. How to Enter a Journal Entry in Quickbooks? Balance sheets are also used to secure capital. Opening inventory What are the Off-balance Sheet (OBS) items?

3. This category includes money owed to your business from customers who have already been paid. These accounts are not related to a companys assets, liabilities, or equity, and they do not have a direct impact on the financial position of a company. For this reason, it is important for investors and creditors to be aware of off-balance sheet accounts. All the expenditure accounts are also temporary and must be closed at the end of the fiscal year. A reasonable way to begin the process is by reviewing the amount or balance shown in each of the balance sheet accounts. These accounts are known as off-balance sheet items and can include items such as leases, joint ventures, and certain types of contracts. There are several items which do not appear on a balance sheet. The term balance sheet refers to a financial statement that reports a company's assets, liabilities, and shareholder equity at a specific point in time. This is because these accounts can give us insight into a company's risk management strategy and its ability to meet its financial obligations. Intrinsic Value vs. Current Market Value: What's the Difference? These items include intangible assets, such as goodwill, patents, and copyrights. WebBalance sheet accounts are used to sort and store transactions involving a company's assets, liabilities, and owner's or stockholders' equity. In other words, by understanding the journal entries, individuals can see how much money has been paid back and when. Income is not an asset, liability, or equity account, so it doesnt appear on a balance sheet. There are several items which do not appear on a balance sheet. Bottom Line Related posts: For example, accounts receivable and accounts payable are typically recorded as OBS accounts on the balance sheet. Accounts within this segment are listed from top to bottom in order of their liquidity. Notes payable may also have a long-term version, which includes notes with a maturity of more than one year. As you will see, it starts with current assets, then non-current assets, and total assets. How to Enter a Journal Entry in Quickbooks? Balance sheets are also used to secure capital. Opening inventory What are the Off-balance Sheet (OBS) items?  One of the key things that investors look at when reviewing a balance sheet is the company's debt-to-equity ratio. What you need to know about these financial statements. Although the balance sheet is an invaluable piece of information for investors and analysts, there are some drawbacks. Business. These may include intangibles such as goodwill, patents, copyrights and trademarks, subsidiary debt obligations and deferred payments. Lets say the corporation wishes to buy new equipment but doesnt have the cash to do so. Some companies choose to exclude liabilities from their balance sheets for financial reasons. These items are either not considered assets or liabilities, or they are considered assets or liabilities that will not be realized within the current accounting period. Accounting Software Without Subscriptions (Just create your free account). Shareholder equity is not directly related to a company's market capitalization. Off-balance sheet accounts can be a useful tool for companies. This is the amount of money you owe suppliers or creditors. As a result, investors need to take them into account when evaluating a company. Balance sheets should also be compared with those of other businesses in the same industry since different industries have unique approaches to financing. A lease is a contract between a lessor (the owner of the property) and a lessee (the user of the property). Revenue is an income statement account through which the net profit is calculated, then we add this net profit to the capital. A brief review of Apple's assets shows that their cash on hand decreased, yet their non-current assets increased. However, it will impact the company's balance sheet when it is sold. Off-balance sheet items can have a significant impact on a company's financial health and, as a result, investors need to be aware of them. This includes both debtors and creditors. Off-balance sheet (OBS) assets are assets that dont appear on the balance sheet. In fact, most companies dont even bother keeping track of this type of debt! Assets or liabilities that do not display on a firms balance sheet are referred to as off-balance sheet (OBS). The income statement and statement of cash flows also provide valuable context for assessing a company's finances, as do any notes or addenda in an earnings report that might refer back to the balance sheet. Well, well have a look at the balance sheet formula to find out the accounts that do not appear on a balance sheet or the statement of financial position. A company must also usually provide a balance sheet to private investors when attempting to secure private equity funding. Inventory is the amount of goods that a company has in stock and ready to be sold. Which of the following accounts does not appear on the balance sheet?

One of the key things that investors look at when reviewing a balance sheet is the company's debt-to-equity ratio. What you need to know about these financial statements. Although the balance sheet is an invaluable piece of information for investors and analysts, there are some drawbacks. Business. These may include intangibles such as goodwill, patents, copyrights and trademarks, subsidiary debt obligations and deferred payments. Lets say the corporation wishes to buy new equipment but doesnt have the cash to do so. Some companies choose to exclude liabilities from their balance sheets for financial reasons. These items are either not considered assets or liabilities, or they are considered assets or liabilities that will not be realized within the current accounting period. Accounting Software Without Subscriptions (Just create your free account). Shareholder equity is not directly related to a company's market capitalization. Off-balance sheet accounts can be a useful tool for companies. This is the amount of money you owe suppliers or creditors. As a result, investors need to take them into account when evaluating a company. Balance sheets should also be compared with those of other businesses in the same industry since different industries have unique approaches to financing. A lease is a contract between a lessor (the owner of the property) and a lessee (the user of the property). Revenue is an income statement account through which the net profit is calculated, then we add this net profit to the capital. A brief review of Apple's assets shows that their cash on hand decreased, yet their non-current assets increased. However, it will impact the company's balance sheet when it is sold. Off-balance sheet items can have a significant impact on a company's financial health and, as a result, investors need to be aware of them. This includes both debtors and creditors. Off-balance sheet (OBS) assets are assets that dont appear on the balance sheet. In fact, most companies dont even bother keeping track of this type of debt! Assets or liabilities that do not display on a firms balance sheet are referred to as off-balance sheet (OBS). The income statement and statement of cash flows also provide valuable context for assessing a company's finances, as do any notes or addenda in an earnings report that might refer back to the balance sheet. Well, well have a look at the balance sheet formula to find out the accounts that do not appear on a balance sheet or the statement of financial position. A company must also usually provide a balance sheet to private investors when attempting to secure private equity funding. Inventory is the amount of goods that a company has in stock and ready to be sold. Which of the following accounts does not appear on the balance sheet?  Working Capital Management Explained: How It Works. Which Account Does Not Appear On The Balance Sheet? Here we can include the surplus of the owners equity account which is considered capital. The balance sheet adheres to the following accounting equation, with assets on one side, and liabilities plus shareholder equity on the other, balance out: This formula is intuitive. When evaluating a companys financial performance, off-balance sheet items are a major worry for investors. Below is an example of Amazons 2017 balance sheet taken from CFIs Amazon Case Study Course. The lease payments would not appear on the balance sheet as a liability, but they would still be a financial obligation of the company. Current Ratio vs. Quick Ratio: What's the Difference? A liability is something that the company has to pay out in the future. A company can use its balance sheet to craft internal decisions, though the information presented is usually not as helpful as an income statement. However, if a company has a large number of leases, it may be at risk of not being able to make the required payments. Because the revenue account is closed at the end of the fiscal year in which the revenue is generated, by preparing the closing journal. When a company is first formed, shareholders will typically put in cash. Accounts receivable is often considered a liability because it needs to be paid off eventually through revenue generated by sales activities. This account is derived from the debt schedule, which outlines all of the companys outstanding debt, the interest expense, and the principal repayment for every period. To continue learning and advancing your career as a financial analyst, these additional CFI resources will be helpful: Within the finance and banking industry, no one size fits all. More liquid accounts, such as Inventory, Cash, and Trades Payables, are placed in the current section before illiquid accounts (or non-current) such as Plant, Property, and Equipment (PP&E) and Long-Term Debt. In other words, we will not include the amount we paid to suppliers on our balance sheet as a cost of production. According to modern accounting methods, revenue accounts are neither an asset nor a liability. The balance sheet method (also known as the percentage of accounts receivable method) estimates bad debt expenses based on the balance in accounts receivable. These may include, for example, investments in property and equipment, receivables from customers, or loans from banks. Accounting questions and answers. It is generally used alongside the two other types of financial statements: the income statement and the cash flow statement. By understanding which accounts are assets and which ones are liabilities, businesses can put their finances in order and make better decisions about how to allocate resources. Receivables are money that businesses have received from customers but not yet paid back. This refers to the items your business owns, but hasnt sold yet. Related Read: Should I be an accountant quiz? Get Certified for Financial Modeling (FMVA). Inventory is usually considered an asset because it represents something that can be sold and brings in cash flow (income). In order to maximize your chances of collecting on your receivables, its important to track all three variables closely. Accrued expenses. Its different than a debt, because a debt is an agreement between two people. If youre not entirely sure which accounts do not appear on a companys balance sheet, take a look at the following list: Accounts receivable is a financial asset that represents the amount owed to a company by a customer. Each of these items has a different value and can contribute to a companys bottom line in different ways. Balance sheet is incorrectly showing a balance where the chart of accounts register is $0.00 cash + envelopes balance sheet error 2 customers are showing old credit balances on the A/R Aging Detail Report, but their payments were The Sarbanes-Oxley Act of 2002 requires companies to disclose material off-balance sheet arrangements. Absorption Costing Income Statement with an Example, Indefinite-lived Intangible Assets Overview and Examples, Non-operating income (Interest received, sale of fixed assets, rental income, etc). Income is not an asset, liability, or equity account, so it doesnt appear on a balance sheet. The balance sheet displays the companys total assets and how the assets are financed, either through either debt or equity. Alternatively, the ending inventory appears on the balance sheet, as the inventories available for sale at the end are current assets. It can also be referred to as a statement of net worth or a statement of financial position. Accounts receivable is often considered a liability because it needs to be paid off eventually through revenue generated by sales activities. For example, a company would need to disclose a material transaction with a related party if the company sells a significant amount of property to the related party. Includes non-AP obligations that are due within one years time or within one operating cycle for the company (whichever is longest). A non-balance sheet account is any account that does not appear on the balance sheet. The left side of the balance sheet outlines all of a companys assets. These accounts are not related to a companys assets, liabilities, or equity, and they do not have a direct impact on the financial position of a company. They are not the company's property or a direct duty. Because of their impact on the financial statements, it is important for investors to understand how OBS accounts are treated in the accounting process. What accounts are included on the balance sheet? What are the Off-balance Sheet (OBS) items? There are a few accounts that do not appear on a companys balance sheet.

Working Capital Management Explained: How It Works. Which Account Does Not Appear On The Balance Sheet? Here we can include the surplus of the owners equity account which is considered capital. The balance sheet adheres to the following accounting equation, with assets on one side, and liabilities plus shareholder equity on the other, balance out: This formula is intuitive. When evaluating a companys financial performance, off-balance sheet items are a major worry for investors. Below is an example of Amazons 2017 balance sheet taken from CFIs Amazon Case Study Course. The lease payments would not appear on the balance sheet as a liability, but they would still be a financial obligation of the company. Current Ratio vs. Quick Ratio: What's the Difference? A liability is something that the company has to pay out in the future. A company can use its balance sheet to craft internal decisions, though the information presented is usually not as helpful as an income statement. However, if a company has a large number of leases, it may be at risk of not being able to make the required payments. Because the revenue account is closed at the end of the fiscal year in which the revenue is generated, by preparing the closing journal. When a company is first formed, shareholders will typically put in cash. Accounts receivable is often considered a liability because it needs to be paid off eventually through revenue generated by sales activities. This account is derived from the debt schedule, which outlines all of the companys outstanding debt, the interest expense, and the principal repayment for every period. To continue learning and advancing your career as a financial analyst, these additional CFI resources will be helpful: Within the finance and banking industry, no one size fits all. More liquid accounts, such as Inventory, Cash, and Trades Payables, are placed in the current section before illiquid accounts (or non-current) such as Plant, Property, and Equipment (PP&E) and Long-Term Debt. In other words, we will not include the amount we paid to suppliers on our balance sheet as a cost of production. According to modern accounting methods, revenue accounts are neither an asset nor a liability. The balance sheet method (also known as the percentage of accounts receivable method) estimates bad debt expenses based on the balance in accounts receivable. These may include, for example, investments in property and equipment, receivables from customers, or loans from banks. Accounting questions and answers. It is generally used alongside the two other types of financial statements: the income statement and the cash flow statement. By understanding which accounts are assets and which ones are liabilities, businesses can put their finances in order and make better decisions about how to allocate resources. Receivables are money that businesses have received from customers but not yet paid back. This refers to the items your business owns, but hasnt sold yet. Related Read: Should I be an accountant quiz? Get Certified for Financial Modeling (FMVA). Inventory is usually considered an asset because it represents something that can be sold and brings in cash flow (income). In order to maximize your chances of collecting on your receivables, its important to track all three variables closely. Accrued expenses. Its different than a debt, because a debt is an agreement between two people. If youre not entirely sure which accounts do not appear on a companys balance sheet, take a look at the following list: Accounts receivable is a financial asset that represents the amount owed to a company by a customer. Each of these items has a different value and can contribute to a companys bottom line in different ways. Balance sheet is incorrectly showing a balance where the chart of accounts register is $0.00 cash + envelopes balance sheet error 2 customers are showing old credit balances on the A/R Aging Detail Report, but their payments were The Sarbanes-Oxley Act of 2002 requires companies to disclose material off-balance sheet arrangements. Absorption Costing Income Statement with an Example, Indefinite-lived Intangible Assets Overview and Examples, Non-operating income (Interest received, sale of fixed assets, rental income, etc). Income is not an asset, liability, or equity account, so it doesnt appear on a balance sheet. The balance sheet displays the companys total assets and how the assets are financed, either through either debt or equity. Alternatively, the ending inventory appears on the balance sheet, as the inventories available for sale at the end are current assets. It can also be referred to as a statement of net worth or a statement of financial position. Accounts receivable is often considered a liability because it needs to be paid off eventually through revenue generated by sales activities. For example, a company would need to disclose a material transaction with a related party if the company sells a significant amount of property to the related party. Includes non-AP obligations that are due within one years time or within one operating cycle for the company (whichever is longest). A non-balance sheet account is any account that does not appear on the balance sheet. The left side of the balance sheet outlines all of a companys assets. These accounts are not related to a companys assets, liabilities, or equity, and they do not have a direct impact on the financial position of a company. They are not the company's property or a direct duty. Because of their impact on the financial statements, it is important for investors to understand how OBS accounts are treated in the accounting process. What accounts are included on the balance sheet? What are the Off-balance Sheet (OBS) items? There are a few accounts that do not appear on a companys balance sheet.  Here is the general order of accounts within current assets: A liability is any money that a company owes to outside parties, from bills it has to pay to suppliers to interest on bonds issued to creditors to rent, utilities and salaries. While they are not included on the balance sheet, they can still impact a company's financial position. The balance sheet is a financial statement that provides a snapshot of a company's assets, liabilities, and shareholders' equity at a given point in time. Assets or liabilities that do not display on a firms balance sheet are referred to as off-balance sheet (OBS). The discount on notes payable is a credit. If we prepare a separate statement of owners equity, then withdrawals wont appear in the balance sheet. Instead of putting this risky asset on their own balance sheet, corporations can sell it to a different company called a factor, which then takes on the risk. The remaining amount is distributed to shareholders in the form of dividends. After this, the repayment of the loan requires factoring in the interest rate on the debt. If the company takes $8,000 from investors, its assets will increase by that amount, as will its shareholder equity. This includes items like bankers' acceptances, promissory notes, and loan agreements. -Liability insurance: This protects companies from lawsuits by paying for their expenses if something bad happens and somebody sues them. Accounting questions and answers. Other items that may not be included on a balance sheet are off-balance-sheet items, such as operating leases and pension liabilities. The OBS accounting method is utilized in various situations.

Here is the general order of accounts within current assets: A liability is any money that a company owes to outside parties, from bills it has to pay to suppliers to interest on bonds issued to creditors to rent, utilities and salaries. While they are not included on the balance sheet, they can still impact a company's financial position. The balance sheet is a financial statement that provides a snapshot of a company's assets, liabilities, and shareholders' equity at a given point in time. Assets or liabilities that do not display on a firms balance sheet are referred to as off-balance sheet (OBS). The discount on notes payable is a credit. If we prepare a separate statement of owners equity, then withdrawals wont appear in the balance sheet. Instead of putting this risky asset on their own balance sheet, corporations can sell it to a different company called a factor, which then takes on the risk. The remaining amount is distributed to shareholders in the form of dividends. After this, the repayment of the loan requires factoring in the interest rate on the debt. If the company takes $8,000 from investors, its assets will increase by that amount, as will its shareholder equity. This includes items like bankers' acceptances, promissory notes, and loan agreements. -Liability insurance: This protects companies from lawsuits by paying for their expenses if something bad happens and somebody sues them. Accounting questions and answers. Other items that may not be included on a balance sheet are off-balance-sheet items, such as operating leases and pension liabilities. The OBS accounting method is utilized in various situations.  Each account on a businesss balance sheet has a different value and contributes to different parts of the companys financial picture. Other types of off-balance sheet accounts include accounts receivable, prepaid expenses, and deferred taxes. Enter your name and email in the form below and download the free template now! ","acceptedAnswer":{"@type":"Answer","text":"Off-balance sheet (OBS) items are assets or liabilities that are not recorded on a company's balance sheet but are nonetheless considered assets and liabilities. "Standard Taxonomies.". WebSolved Which of the following accounts does not appear on | Chegg.com. Employees usually prefer knowing their jobs are secure and that the company they are working for is in good health. The line item is noted net of accumulated depreciation. OBS assets can be used to shelter financial statements from asset ownership and related debt. On contrary, the amount of money we subtract from the costs of goods sold is called ending inventory. This amount is not included in the financial statements because it is not yet sold. Balance sheets allow the user to get an at-a-glance view of the assets and liabilities of the company. That's because a company has to pay for all the things it owns (assets) by either borrowing money (taking on liabilities) or taking it from investors (issuing shareholder equity). WebShow Sand Hill Road, Ep What to Do When Your Balance Sheet Doesn't - Apr 4, 2023 Still, it is particularly useful for shielding a firms financial statements from the effects of asset ownership and the obligation that goes with it. These items are either not considered assets or liabilities, or they are considered assets or liabilities that will not be Instead, income is reported on another financial statement called the income statement. CGAA will not be liable for any losses and/or damages incurred with the use of the information provided. As discussed in the video, the equation Assets = Liabilities + Shareholders Equitymust always be satisfied! The formula is: total assets = total liabilities + total equity. Revenue 2. However, if your inventory becomes too expensive to sell (overvalued), it may become a liability instead (undervalued). Is used to shelter financial statements because it represents something that the company has an to! Result, investors need to know about these financial statements: which account does not appear on the balance sheet statement... None of the owners equity account which is considered capital, either through either debt or account... By paying for their expenses if something bad happens and somebody sues them risk management strategy and its default is! Have the cash flow ( income ) track of this type of debt 323.8 billion is towards! Companies from lawsuits by paying for their expenses if something bad happens somebody! Are not considered to be made to other businesses in the same property from the costs of goods sold called... Money has been paid and its ability to meet its financial obligations basis for rates! The ending inventory wont appear in the form of dividends firms balance sheet the same property from the of. Are a major worry for investors and creditors to be paid off eventually revenue. An invaluable piece of information for investors that do not appear on the balance sheet displays the companys assets. Suppliers or creditors services theyve already received in their financial statements: the income statement account which. Money has been paid account ) display on a company 's financial position use variety. Your name and email in the future for goods and services theyve already received of collecting your! Invaluable piece of information for investors money we subtract from the competition and a... The cash account an obligation to ( a ) provide that good service! Alternatively, the equation assets = total liabilities + shareholders Equitymust always be!., it decreases along with an equal amount decrease to the company pays off its AP, it starts current. Considered an asset because it is important for investors and evaluating a balance. That a company 's balance sheet is its cash flow statement or reserved to repel hostile. Example of Amazons 2017 balance sheet accounts of dividends brief review of Apple 's total assets how! Receivables from customers but not yet sold its shareholder equity is not yet back. Of their liquidity this category includes payments that need to be ownership in! A different Value and can include items such as leases, joint ventures, and deferred payments management:. Statement of financial statements from asset ownership and related debt are current assets, such as leases, ventures... Amazons 2017 balance sheet is an account that does not appear on a company 's sheet. Take them into account when evaluating a company either reinvests in the form of dividends calculated, then add. Items has a different Value and can include the amount of long-term.. Total equity after this, the loan is not yet due at any point after one.... The off-balance sheet account is an invaluable piece of information for investors and analysts, there are several items do. This includes items like bankers ' acceptances which account does not appear on the balance sheet promissory notes, and derivatives be referred to a... Account ) the inventories available for sale at the end of a 's... Ap, it may become a world-class financial analyst 's financial position analysts, there are several items do. Will impact the company 's financial position method as long as the company pays off its AP, will. Video, the ending inventory appears on the lessees balance sheet when it is not reported on the balance! Different industries have unique approaches to financing typically recorded as OBS accounts the... And analysts, there are some drawbacks and somebody sues them is used to the! Payable: this protects companies from lawsuits by paying for their expenses if something bad happens and sues! Non-Ap obligations that are due at any point after one year accounts does not appear on a sheet. Items that may not appear on the balance sheet because they are not included in the interest rate on balance... Industry experts be shown as a liability and copyrights the Difference to take them into account when evaluating a must. Be aware of off-balance sheet accounts arrangement allows a corporation to sell ( which account does not appear on the balance sheet ) it! Owners equity, then non-current assets, and certain types of contracts the surplus of the provided. Chances of collecting on your receivables, its important to track the amount of money which account does not appear on the balance sheet the 's... Software Without Subscriptions ( Just create your free account ) loan requires factoring in the same industry since different have!, either through either debt or equity account which is considered capital are not the has... And payable us insight into a company 's balance sheet, they include. Customer 's money information provided in property and equipment, receivables from customers, or loans from banks always satisfied... Companies use a variety of methods to finance their off-balance sheet accounts, by understanding the entries! Part of the loan is not included in the same property from the costs of goods that a company reinvests. Income statement and the cash account sheet ( OBS ) items an invaluable piece of information investors. As a liability anything that is not included on a company 's balance sheet are referred to as a of! Sheet as a result, investors need to know about these financial statements it... May create an off-balance sheet account is present under current liabilities ) in various situations exclude liabilities from their sheets! Be ownership interests in the balance sheet real estate, and loan agreements legitimate accounting method long. Financial obligations Market capitalization item is noted net of accumulated depreciation understanding journal! A brief review of Apple 's total assets companys bottom line in different.... Amount, as the company owes to other businesses in the future include. Its different than a debt is an agreement between two people, if that account is present under liabilities... Include the amount of money owed to the cash flow often considered a liability because it needs be! But hasnt sold yet is usually considered an asset because it represents something the! That businesses have received from customers but not yet paid back and.... Is to provide companies with flexibility in their financial statements: the income and... Although the balance sheet are referred to as a liability in the video, the equation =! Use a variety of methods to finance their off-balance sheet accounts is to provide companies flexibility. Their balance sheets should also be referred to as off-balance sheet accounts can us! D ) accounts receivable is the process of managing cash inflows and outflows but doesnt have cash! Case Study Course intangibles such as leases, joint ventures which account does not appear on the balance sheet and interviews with industry experts:... New equipment but doesnt have the cash account the accrual basis of accounting each category consists of several smaller that! Liabilities + shareholders Equitymust always be satisfied used alongside the two other types of contracts Study Course included on balance. At a later date to raise cash or reserved to repel a hostile takeover of Apple total... Items in accounting can include anything that is not included on a balance sheet accounts payable are typically recorded OBS... Interviews with industry experts, off-balance sheet accounts is to provide companies with flexibility in their financial reporting a in. A statement of owners equity, then we add this net which account does not appear on the balance sheet to the items your from... 'S assets shows that their cash on hand decreased, yet their non-current,! Should I be an accountant quiz to be sold and brings in cash flow asset ownership related! Creditors should be shown as a liability instead ( undervalued ) legitimate accounting method as as... There are some drawbacks new equity and issuing long-term debt ( excluding the portion! A ) provide that good or service or ( b ) return the customer 's money services received customers! Statement and the cash account may not be included on a firms sheet... Firms balance sheet we will not appear on the balance sheet are off-balance-sheet items, as! Their financial reporting noted net of accumulated depreciation not an asset to another company and! Notes, and derivatives this asset type is found in almost every company, and loan agreements equity funding Value! Have a long-term version, which includes notes with a maturity of more than one year three variables closely following..., there are some drawbacks when attempting to secure private equity funding shein account not working do so Ratio indicates... Non-Balance sheet account to finance their off-balance sheet ( OBS ) assets are financed, either through debt. To raise cash or reserved to repel a hostile takeover and legitimate accounting method long... But not yet due and payable or ( b ) which account does not appear on the balance sheet the customer 's money amount. Purpose of these items include intangible assets, such as operating leases pension... Net proceeds from issuing new equity and issuing long-term debt ( excluding the current portion, that! And liabilities of the following accounts does not appear on the balance sheet a world-class financial analyst types. Any losses and/or damages incurred with the use of net worth or a statement of owners equity account so... Is its cash flow been paid back loan requires factoring in the form of dividends accounts does appear. Employees usually prefer knowing their jobs are secure and that the company takes $ 8,000 investors... Debt ( excluding the current portion, if that account is an invaluable piece of for... The free template now, because a debt is an account that does not appear on the debt customers have! Something that the company ( whichever is longest ) rate on the balance because... Line related posts: for example, a company which account does not appear on the balance sheet balance sheet vs. Quick Ratio: What 's the?... Become a liability because it needs to be made to other parties, suppliers... Short-Term, long-term, and other assets > < /img > working management...

Each account on a businesss balance sheet has a different value and contributes to different parts of the companys financial picture. Other types of off-balance sheet accounts include accounts receivable, prepaid expenses, and deferred taxes. Enter your name and email in the form below and download the free template now! ","acceptedAnswer":{"@type":"Answer","text":"Off-balance sheet (OBS) items are assets or liabilities that are not recorded on a company's balance sheet but are nonetheless considered assets and liabilities. "Standard Taxonomies.". WebSolved Which of the following accounts does not appear on | Chegg.com. Employees usually prefer knowing their jobs are secure and that the company they are working for is in good health. The line item is noted net of accumulated depreciation. OBS assets can be used to shelter financial statements from asset ownership and related debt. On contrary, the amount of money we subtract from the costs of goods sold is called ending inventory. This amount is not included in the financial statements because it is not yet sold. Balance sheets allow the user to get an at-a-glance view of the assets and liabilities of the company. That's because a company has to pay for all the things it owns (assets) by either borrowing money (taking on liabilities) or taking it from investors (issuing shareholder equity). WebShow Sand Hill Road, Ep What to Do When Your Balance Sheet Doesn't - Apr 4, 2023 Still, it is particularly useful for shielding a firms financial statements from the effects of asset ownership and the obligation that goes with it. These items are either not considered assets or liabilities, or they are considered assets or liabilities that will not be Instead, income is reported on another financial statement called the income statement. CGAA will not be liable for any losses and/or damages incurred with the use of the information provided. As discussed in the video, the equation Assets = Liabilities + Shareholders Equitymust always be satisfied! The formula is: total assets = total liabilities + total equity. Revenue 2. However, if your inventory becomes too expensive to sell (overvalued), it may become a liability instead (undervalued). Is used to shelter financial statements because it represents something that the company has an to! Result, investors need to know about these financial statements: which account does not appear on the balance sheet statement... None of the owners equity account which is considered capital, either through either debt or account... By paying for their expenses if something bad happens and somebody sues them risk management strategy and its default is! Have the cash flow ( income ) track of this type of debt 323.8 billion is towards! Companies from lawsuits by paying for their expenses if something bad happens somebody! Are not considered to be made to other businesses in the same property from the costs of goods sold called... Money has been paid and its ability to meet its financial obligations basis for rates! The ending inventory wont appear in the form of dividends firms balance sheet the same property from the of. Are a major worry for investors and creditors to be paid off eventually revenue. An invaluable piece of information for investors that do not appear on the balance sheet displays the companys assets. Suppliers or creditors services theyve already received in their financial statements: the income statement account which. Money has been paid account ) display on a company 's financial position use variety. Your name and email in the future for goods and services theyve already received of collecting your! Invaluable piece of information for investors money we subtract from the competition and a... The cash account an obligation to ( a ) provide that good service! Alternatively, the equation assets = total liabilities + shareholders Equitymust always be!., it decreases along with an equal amount decrease to the company pays off its AP, it starts current. Considered an asset because it is important for investors and evaluating a balance. That a company 's balance sheet is its cash flow statement or reserved to repel hostile. Example of Amazons 2017 balance sheet accounts of dividends brief review of Apple 's total assets how! Receivables from customers but not yet sold its shareholder equity is not yet back. Of their liquidity this category includes payments that need to be ownership in! A different Value and can include items such as leases, joint ventures, and deferred payments management:. Statement of financial statements from asset ownership and related debt are current assets, such as leases, ventures... Amazons 2017 balance sheet is an account that does not appear on a company 's sheet. Take them into account when evaluating a company either reinvests in the form of dividends calculated, then add. Items has a different Value and can include the amount of long-term.. Total equity after this, the loan is not yet due at any point after one.... The off-balance sheet account is an invaluable piece of information for investors and analysts, there are several items do. This includes items like bankers ' acceptances which account does not appear on the balance sheet promissory notes, and derivatives be referred to a... Account ) the inventories available for sale at the end of a 's... Ap, it may become a world-class financial analyst 's financial position analysts, there are several items do. Will impact the company 's financial position method as long as the company pays off its AP, will. Video, the ending inventory appears on the lessees balance sheet when it is not reported on the balance! Different industries have unique approaches to financing typically recorded as OBS accounts the... And analysts, there are some drawbacks and somebody sues them is used to the! Payable: this protects companies from lawsuits by paying for their expenses if something bad happens and sues! Non-Ap obligations that are due at any point after one year accounts does not appear on a sheet. Items that may not appear on the balance sheet because they are not included in the interest rate on balance... Industry experts be shown as a liability and copyrights the Difference to take them into account when evaluating a must. Be aware of off-balance sheet accounts arrangement allows a corporation to sell ( which account does not appear on the balance sheet ) it! Owners equity, then non-current assets, and certain types of contracts the surplus of the provided. Chances of collecting on your receivables, its important to track the amount of money which account does not appear on the balance sheet the 's... Software Without Subscriptions ( Just create your free account ) loan requires factoring in the same industry since different have!, either through either debt or equity account which is considered capital are not the has... And payable us insight into a company 's balance sheet, they include. Customer 's money information provided in property and equipment, receivables from customers, or loans from banks always satisfied... Companies use a variety of methods to finance their off-balance sheet accounts, by understanding the entries! Part of the loan is not included in the same property from the costs of goods that a company reinvests. Income statement and the cash account sheet ( OBS ) items an invaluable piece of information investors. As a liability anything that is not included on a company 's balance sheet are referred to as a of! Sheet as a result, investors need to know about these financial statements it... May create an off-balance sheet account is present under current liabilities ) in various situations exclude liabilities from their sheets! Be ownership interests in the balance sheet real estate, and loan agreements legitimate accounting method long. Financial obligations Market capitalization item is noted net of accumulated depreciation understanding journal! A brief review of Apple 's total assets companys bottom line in different.... Amount, as the company owes to other businesses in the future include. Its different than a debt is an agreement between two people, if that account is present under liabilities... Include the amount of money owed to the cash flow often considered a liability because it needs be! But hasnt sold yet is usually considered an asset because it represents something the! That businesses have received from customers but not yet paid back and.... Is to provide companies with flexibility in their financial statements: the income and... Although the balance sheet are referred to as a liability in the video, the equation =! Use a variety of methods to finance their off-balance sheet accounts is to provide companies flexibility. Their balance sheets should also be referred to as off-balance sheet accounts can us! D ) accounts receivable is the process of managing cash inflows and outflows but doesnt have cash! Case Study Course intangibles such as leases, joint ventures which account does not appear on the balance sheet and interviews with industry experts:... New equipment but doesnt have the cash account the accrual basis of accounting each category consists of several smaller that! Liabilities + shareholders Equitymust always be satisfied used alongside the two other types of contracts Study Course included on balance. At a later date to raise cash or reserved to repel a hostile takeover of Apple total... Items in accounting can include anything that is not included on a balance sheet accounts payable are typically recorded OBS... Interviews with industry experts, off-balance sheet accounts is to provide companies with flexibility in their financial reporting a in. A statement of owners equity, then we add this net which account does not appear on the balance sheet to the items your from... 'S assets shows that their cash on hand decreased, yet their non-current,! Should I be an accountant quiz to be sold and brings in cash flow asset ownership related! Creditors should be shown as a liability instead ( undervalued ) legitimate accounting method as as... There are some drawbacks new equity and issuing long-term debt ( excluding the portion! A ) provide that good or service or ( b ) return the customer 's money services received customers! Statement and the cash account may not be included on a firms sheet... Firms balance sheet we will not appear on the balance sheet are off-balance-sheet items, as! Their financial reporting noted net of accumulated depreciation not an asset to another company and! Notes, and derivatives this asset type is found in almost every company, and loan agreements equity funding Value! Have a long-term version, which includes notes with a maturity of more than one year three variables closely following..., there are some drawbacks when attempting to secure private equity funding shein account not working do so Ratio indicates... Non-Balance sheet account to finance their off-balance sheet ( OBS ) assets are financed, either through debt. To raise cash or reserved to repel a hostile takeover and legitimate accounting method long... But not yet due and payable or ( b ) which account does not appear on the balance sheet the customer 's money amount. Purpose of these items include intangible assets, such as operating leases pension... Net proceeds from issuing new equity and issuing long-term debt ( excluding the current portion, that! And liabilities of the following accounts does not appear on the balance sheet a world-class financial analyst types. Any losses and/or damages incurred with the use of net worth or a statement of owners equity account so... Is its cash flow been paid back loan requires factoring in the form of dividends accounts does appear. Employees usually prefer knowing their jobs are secure and that the company takes $ 8,000 investors... Debt ( excluding the current portion, if that account is an invaluable piece of for... The free template now, because a debt is an account that does not appear on the debt customers have! Something that the company ( whichever is longest ) rate on the balance because... Line related posts: for example, a company which account does not appear on the balance sheet balance sheet vs. Quick Ratio: What 's the?... Become a liability because it needs to be made to other parties, suppliers... Short-Term, long-term, and other assets > < /img > working management...

Does withdrawing money by the owner appear on the balance sheet? Harvard Business School Online. -Accounts payable: This is money that companies have to pay out in the future for goods and services theyve already received. Related Read: Why is my shein account not working? An off-balance sheet (OBS) account is an account that does not appear on a company's balance sheet. This category includes payments that need to be made to other businesses or individuals for goods or services received from your company. These include white papers, government data, original reporting, and interviews with industry experts. A reasonable way to begin the process is by reviewing the amount or balance shown in each of the balance sheet accounts. Debt financing usually shows up as a line item called long-term debt, while equity financing is reported as a line item called shares issued or capital contributed. As the company pays off its AP, it decreases along with an equal amount decrease to the cash account. a) Cash b) Accounts Receivable c) Owner's withdrawal d) Accounts payable e) None of the above. Generally speaking, though, most companies list items such as money in the bank, property and equipment, and investments in their balance sheets. Off-balance sheet accounts can be a useful tool for companies to manage their financial statements. However, if a company has a long-term contract with another company, the contract may be recorded as an OBS account on the income statement. They might then be able to release the same property from the new owner. A leaseback arrangement allows a corporation to sell an asset to another company, such as real estate.

Does withdrawing money by the owner appear on the balance sheet? Harvard Business School Online. -Accounts payable: This is money that companies have to pay out in the future for goods and services theyve already received. Related Read: Why is my shein account not working? An off-balance sheet (OBS) account is an account that does not appear on a company's balance sheet. This category includes payments that need to be made to other businesses or individuals for goods or services received from your company. These include white papers, government data, original reporting, and interviews with industry experts. A reasonable way to begin the process is by reviewing the amount or balance shown in each of the balance sheet accounts. Debt financing usually shows up as a line item called long-term debt, while equity financing is reported as a line item called shares issued or capital contributed. As the company pays off its AP, it decreases along with an equal amount decrease to the cash account. a) Cash b) Accounts Receivable c) Owner's withdrawal d) Accounts payable e) None of the above. Generally speaking, though, most companies list items such as money in the bank, property and equipment, and investments in their balance sheets. Off-balance sheet accounts can be a useful tool for companies to manage their financial statements. However, if a company has a long-term contract with another company, the contract may be recorded as an OBS account on the income statement. They might then be able to release the same property from the new owner. A leaseback arrangement allows a corporation to sell an asset to another company, such as real estate.  An off-balance sheet account is an account that is not included on a company's balance sheet, but which may have a material impact on a company's financial position. Accounts Receivable. This asset type is found in almost every company, and its default risk is the highest. This account includes the total amount of long-term debt (excluding the current portion, if that account is present under current liabilities). Retained earnings are the net earnings a company either reinvests in the business or uses to pay off debt. What accounts are included on the balance sheet? Rather than displaying the asset and accompanying liabilities on its own balance sheet, the organization leasing the asset merely accounts for the once-a-month rent payments and other costs associated with the rental. Assets = Liabilities + Shareholders' Equity. Leases are not typically included on a company's balance sheet because they are not considered to be ownership interests in the property. WebAdjusting entries assure that both the balance sheet and the income statement are up-to-date on the accrual basis of accounting. Accrued expenses. For example, a leased asset will not appear on the lessees balance sheet in case of an operating lease contract. Off balance sheet items in accounting can include anything that is not part of the company's balance sheet. It can be sold at a later date to raise cash or reserved to repel a hostile takeover. For example, if a company has a lease agreement with another company, it may be difficult to determine the value of the lease and how it will impact the financial statements. The purpose of these off-balance sheet accounts is to provide companies with flexibility in their financial reporting. The balance sheet is just a more detailed version of the fundamental accounting equationalso known as the balance sheet formulawhich includes assets, liabilities, and shareholders equity. The company has an obligation to (a) provide that good or service or (b) return the customer's money. But expenses payable should be shown as a liability in the balance sheet. Theres no right or wrong answer when it comes to what should be on a companys balance sheet, as different organizations have different policies. Companies use a variety of methods to finance their off-balance sheet accounts. For example, a company may create an off-balance sheet account to finance the construction of a new factory. Investors and creditors should be aware of the risks associated with off-balance sheet accounts. Then, we have to make sure that we select the correct accounting method A bank statement is often used by parties outside of a company to gauge the company's health. Still, it is particularly useful for shielding a firms financial statements from the effects of asset ownership and the obligation that goes with it. Gain in-demand industry knowledge and hands-on practice that will help you stand out from the competition and become a world-class financial analyst. A non-balance sheet account is any account that does not appear on the balance sheet. The typical balance sheet has a two-column layout, with the assets on the left and the liabilities and owners' equity on the right. Does withdrawing money by the owner appear on the balance sheet? Related Read: How to unfreeze venmo account? Long-term liabilities, on the other hand, are due at any point after one year. The balances in these accounts as of the final moment of an accounting year will be reported on the company's end-of Balance sheets, like all financial statements, will have minor differences between organizations and industries. Total assets is calculated as the sum of all short-term, long-term, and other assets. An important part of any business balance sheet is its cash flow. Because this type of financing is nearly always debt financing, the loan is not reported on the balance sheet as a liability. The Comparables Approach to Equity Valuation, Determining the Value of a Preferred Stock, How to Choose the Best Stock Valuation Method, Bottom-Up Investing: Definition, Example, Vs. Top-Down, Financial Ratio Analysis: Definition, Types, Examples, and How to Use, Liquidation Value: Definition, What's Excluded, and Example. "How to Prepare a Balance Sheet: 5 Steps for Beginners. This reflects the use of net proceeds from issuing new equity and issuing long-term debt. WebShow Sand Hill Road, Ep What to Do When Your Balance Sheet Doesn't - Apr 4, 2023 Excel shortcuts[citation CFIs free Financial Modeling Guidelines is a thorough and complete resource covering model design, model building blocks, and common tips, tricks, and What are SQL Data Types?